Reference no: EM13376903

Question 1

Juan is a Puerto Rican resident employed by a Puerto Rican company. Juan is sent to Australia to work on a short-term project to assist with the establishment of a branch of this company in Australia. Juan worked in Australia for 30 days. Throughout this time, Juan continued to receive a salary from his employer. The salary was paid into his Puerto Rican bank account. During the year Juan earned A$155,000 from his employment.

Required:

Advise whether Juan has to pay Australian Tax on any of his salary?

In your answer, refer to case law and legislation when necessary to support your answer.

Question 2

Are all receipts of a taxpayer that carries on a business income in nature?

In your answer, refer to case law and legislation when necessary to support your answer.

Question 3

On 1st October 2012, company EndX Pty. Ltd. purchased a new car for $45,000, inclusive of GST. Registration amounting to $450 was paid before delivery on 1st October 2012.

The car was made available to Mick, a company employee. Due to lack of storage facilities at the company premises, Mick took the car home to be garaged each night.

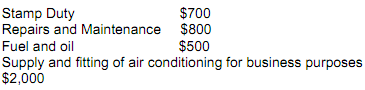

Expenses incurred by the company on the motor vehicle for the 2012/2013 fringe benefits years were as follows:

According to the employee's log book, the car travelled 50,000 kilometres in the period 1st October 2012 to 31st March 2013 of which 30,000 kilometres was for business-related travel. The employee paid the company $1,200 towards the cost of fuel for private use.

The company is electing to use the operating cost method to value the car fringe benefit.

Required:

Determine the fringe benefits tax payable by the employer company in respect of the car fringe benefit for the 2012/2013 fringe benefits tax year. All expenses were inclusive of the Goods and Services Tax.

In your answer, refer to legislation when necessary to support your answer.