Reference no: EM13376124

Question 1:

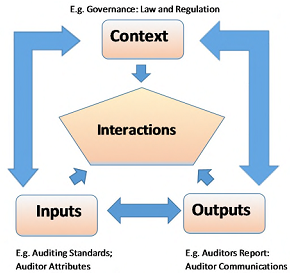

Important influences on Audit Quality

In 2012 the IAASB identified their essential goals were to:

- Raise awareness of the key elements of audit quality

- Encourage key stakeholders to reflect on ways to improve audit quality

- Facilitate greater dialogue between key stakeholders on the topic

Identify and explain how this is being achieved

Question 2.

The Sarbanes-Oxley Act of 2002 requires the Public Company Accounting Oversight Board ("PCAOB" or "the Board") to conduct an annual inspection of each registered public accounting firm that regularly provides audit reports for more than 100 issuers In April 2009 the Public Company Accounting Oversight Board (PCAOB) as part of its inspection regime investigated Deloitte & Touche LLP. Later in April 2010 the PCAOB determined that Deloitte & Touche LLP had not addressed the issues arising from the inspection.

The deficiencies in the inspection identified were of such significance that it appeared to the inspection team, at the time the audit report was issued, Deloitte & Touche LLP had not obtained sufficient competent evidential matter to support its opinion on the issuer's financial statements or internal control over financial reporting. General observations concerning the audit performance suggested that important issues existed concerning:

- The sufficiency of the Firm's emphasis on the critical need to exercise due care and professional skepticism when performing audits;

- The Firm's supervision and review activities to ensure that the audit is performed thoroughly and with due care;

Research PCAOB Releases for at least two years and comment/describe the nature and type of issues/failings being found by the PCAOB

Question 3.

The premise behind auditing standards is that they will lead to uniform audit processes and thus lead to consistent outcomes.Whether auditors are consistent and accurate in their auditing practices is clearly of interest to regulators. Inconsistencies may arise out of either deficient application of the auditing standards by auditors, or deficient standards with insufficient guidelines to ensure consistency in interpretation, and in turn, consistency in audit outcomes. Discuss the above in terms of the issue of the going concern

Question 4.

Describe and explain the nature and scope of forensic auditing and how it differs fromthe normal statutory audit of companies