Reference no: EM13380917

Question 1:

Giving examples where possible, explain any three of the following

a) Perfect capital markets and Fisher's separation theorem

b) The payback period rule

c) Financial analysts' valuation of companies

d) The long-term underperformance of IPOs and SEOs

Question 2:

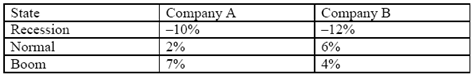

a) Consider the stocks of Company A and Company B. For these stocks, you forecast the following returns (shown in the table below) depending on the state of the world. You expect that the three states of the world are equally likely.

i. For EACH of the two stocks separately, calculate its expected return and standard deviation.

ii. To calculate the portfolio return, there are two possible methods.

1) Briefly outline BOTH possible methods (no need for actual calculations here).

2) Calculate the expected return and standard deviation of a portfolio invested equally in the two stocks using the method of your own choice (i.e. one of the two methods you outlined in part (1) above).

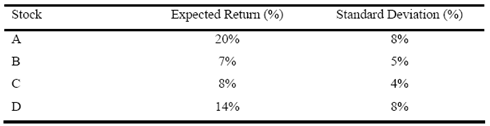

b) Suppose an investor is considering the following four stocks. The table below shows the expected returns and standard deviations of returns of the stocks.

Suppose the investor wants to invest all her wealth in just one single stock from the list of four stocks above. According to mean-variance analysis, how should the investor select the single stock? Briefly explain your answer.

c) Explain to the investor the advantages of investing in a broad portfolio that includes all four stocks in the table in part (b) above along with 20 other stocks from various industries.