Reference no: EM13374672

Question 1: Are the statements below true or false? Explain the reasons for your answers.

- A country which decides to join a Monetary Union expects an increased ability to stabilize its output around the full employment level and keep inflation low compared with its initial ability under flexible exchange rates.

- Suppose that the United States is on a bimetallic standard at $35 to one ounce of gold and $3 for one ounce of silver. If new silver mines open and flood the market with silver, the two metals will circulate as before in the US since citizens could exchange their gold currency for silver currency at any time.

- It is impossible for a country to run both current account surplus and capital account surplus in the same year.

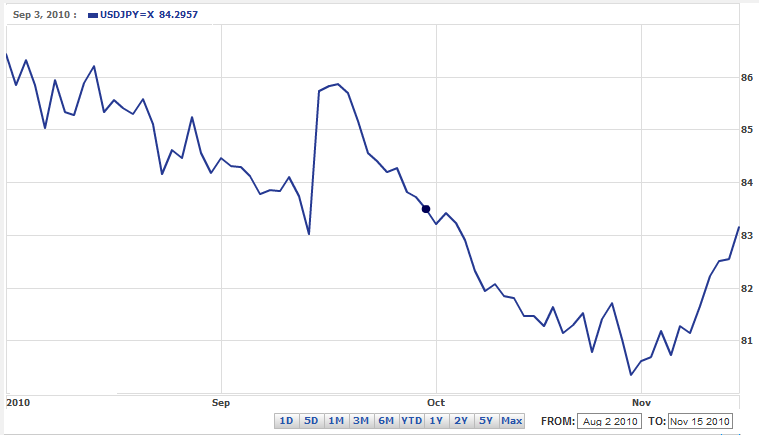

Question 2: The graph below is the exchange rate of Japanese Yen to US dollar (¥/$) between August to November 2010. On 15th Sept, Yen moved from 83 to 85.7 yen per dollar due to the Japanese authorities' intervention in the foreign exchange markets to weaken the value of the yen against the dollar, a day after the yen hit a 15-year high against the dollar.

- Explain how did Japanese central bank intervene the exchange rate between Yen and Dollar in foreign exchange markets?

- What was the government's justification for the intervention?

- Did the intervention succeed? Explain the reasons for your answer.

Question 3: Assume you are a trader in foreign currencies and you look for arbitrage. From the quote screen on your computer terminal, you observe the exchange rate quotations below

|

Bank Quotations

|

Rate

|

|

Citi Bank :

|

$1.8501/£

|

|

UBS :

|

$1.3325/€

|

|

Barclays Bank :

|

€1.3469/£

|

Show how you can make a triangular arbitrage profit by trading at these prices. (Ignore the ask-bid spread for this question) Assume you have £5,000 with which to conduct the arbitrage.

a. Explain what a triangular arbitrage is. What is a condition that will give rise to a triangular arbitrage opportunity?

b. What €/£ price will eliminate triangular arbitrage?

c. How you can make a triangular arbitrage profit by trading at these prices? What is the profit? Explain and discuss your calculations.

Question 4: A fund manager uses the concepts of purchasing power parity (PPP) and the International Fisher Effect (IFE) to forecast spot exchange rates. He gathers the financial information as follows:

A year ago, the spot rate between pound and dollar is $1.70/£. In the past year, US inflation is 2% and UK inflation is 3.5%. The current spot rate is $1.57/£.

a. What is relative PPP? Calculate the current pound spot rate in dollar that would have been forecast by PPP.

b. Does the PPP hold in this case? What could be the reasons for that?

c. What is IFE? If the expected US one-year interest rate is 0.25%, expected UK one-year interest rate is 0.5%, use IFE to predict the expected pound spot rate in dollar one year from now.