Reference no: EM13371545

Ques 1. What is the need of International Financial Management? List out the difference between domestic Finance & International Finance.

Ques 2. i) An investor has two options to choose from: a) $ 7000 after 1 year b)$ 10000 after 3years.Assuming the discount rate of 9% which alternative he should opt for?

ii) A person would need USD 5000, 6 years from now. How much should he deposit each year in his bank account, if yearly interest rate is 10 %?

Ques3. Zain corporation ltd is trying to decide on replacement decision of its current manually operated machine with a fully automatic version. The existing machine was purchased ten years ago. It has a book value of $ 140000 and remaining life of 10 years salvage value $40000. The machine has recently begun causing problems with breakdown and its costing the company $ 20000 per year in maintenance expenses. The company had been offered $ 100000 for the old machinery as a trade-in on the automatic model which has a deliver price of $ 220000. It is expected to have a ten year life & a salvage value of $ 20000. The new machine will require installation modifications costing $ 40000 to the existing facilities, but it is estimated to have cost savings in materials of $ 80000 per year. Maintenance costs are included in the purchase contract and are borne by machine manufacturer. The tax rate is 40 % .Find out the relevant cash flows

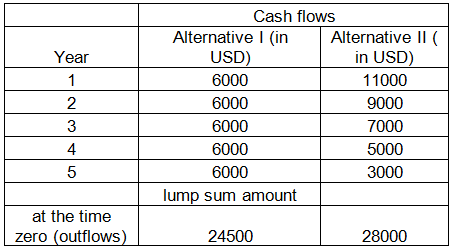

Ques 4. a) You have a choice of accepting either of two

Calculate the payback period and give your opinion that which project is better.

b) Why is the consideration of time important in financial decision making? How can time be adjusted?

Ques 5. Rico Ltd & Sico Ltd are in the same risk class & are identical in all respects except that the company Rico uses debt while company Sico does not use debt. The levered firm has USD 900000 debentures carrying 12 % rate of interest. Both the firms earn 20 % operating profit on their total assets of value USD 25 lacs. The company is in tax bracket of 35% & capitalization rate of 15% on all equity shares.

You are required to compute the value of both the firms using Net Income approach.