Reference no: EM13376871

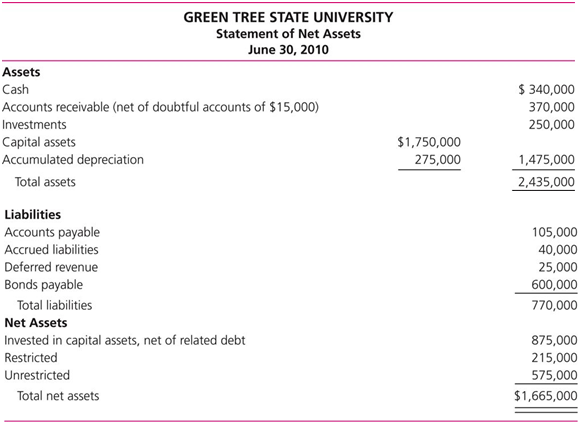

Public University Transactions. The Statement of Net Assets of Green Tree State University, a governmentally owned university, as of the end of its fiscal year June 30, 2010, follows.

The following information pertains to the year ended June 30, 2011:

1. Cash collected from students' tuition totaled $3,000,000. Of this $3,000,000, $362,000 represented accounts receivable outstanding at June 30, 2010; $2,500,000 was for current-year tuition; and $138,000 was for tuition applicable to the semester beginning in August 2011.

2. Deferred revenue at June 30, 2010, was earned during the year ended June 30, 2011.

3. Notification was received from the federal government that up to $50,000 in funds could be received in the current year for costs incurred in developing student performance measures.

4. During the year, the University received an unrestricted appropriation of $60,000 from the state.

5. Equipment for the student computer labs was purchased for cash in the amount of $225,000.

6. During the year, $200,000 in cash contributions was received from alumni. The contributions are to be used for construction of a new library.

7. Interest expense on the bonds payable in the amount of $48,000 was paid.

8. During the year, investments with a carrying value of $25,000 were sold for $31,000. Investments were purchased at a cost of $40,000. Investment income of $18,000 was earned and collected during the year.

9. General expenses of $2,500,000 related to the administration and operation of academic programs, and research expenses of $37,000 related to the development of student performance measures were recorded in the voucher system. At June 30, 2011, the accounts payable balance was $75,000.

10. Accrued liabilities at June 30, 2010, were paid.

11. At year-end, adjusting entries were made. Depreciation on capital assets totaled $90,000. Accrued interest on investments was $1,250. The fair value of investments at year-end was $262,000. The Allowance for Doubtful Accounts was adjusted to $17,000.

12. Nominal accounts were closed and net asset amounts were reclassified as necessary.

Required

a. Prepare journal entries in good form to record the foregoing transactions for the year ended June 30, 2011.

b. Prepare a statement of net assets for the year ended June 30, 2011.