Reference no: EM131472426

Outline

Primitive Energy owns several coal seam gas reserves in south-west Queensland. As a relatively minor player in the Queensland Liquefied Natural Gas (LNG) market, Primitive does not have the capacity to transfer and process the gas for sale to domestic or international buyers. Instead, Primitive simply extracts the gas and then sells it immediately (at the well-head, which is at the surface) to one of the major gas companies operating in the area. Recently, Primitive entered into a contract to sell gas from one of its reserves forthe fixed price of $4.50 per gigajoule (GJ)for the life of the reserve.

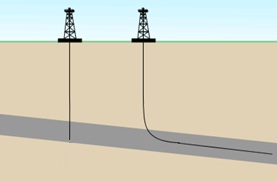

With this contract in place, Primitive's management are currently trying to determine whether they should extract the gas through conventional ‘Vertical' drilling or the recently developed ‘Horizontal' drilling. As indicated in Figure 1, the Vertical drilling approach drills to the coal seam while the Horizontal approach drills down to and then across the coal seam.

Figure 1: Vertical and Horizontal Drilling

Additional points of note are summarised in Table 1.

Table 1: Summary Points for Vertical and Horizontal Drilling

|

Vertical:

|

Smaller capital outlay, however, more wells are generally required due to smaller drainage area (the portion of the reserve that a well can access). Preliminary designs indicate project requires 100 Vertical wells.

|

|

Horizontal:

|

Higher capital outlay given length of drilling, technology and difficulty.Greateraccess to gas reserves and larger spacing between wells, which means fewer wells required. Preliminary designs indicate that project requires 50 Horizontal wells.

|

Specific detail on each of the well types including: capital outlay, production, maintenance, depreciation, state royalties, well drilling and capping schedule and other related information required for analysis is presented in the ‘Well Drilling Information' spreadsheet.

Task

Provide a detailed financial analysis of each well type and an accompanying report that explains and justifies methodology, recommends a well type and highlights limitations with the analysis and recommendations. To complete this task, the manager has requested the following:

- The financial analysis is to be completed in Excel. The file is to be easily adjustable for different scenarios and all inputs must be in the one sheet called ‘Assumptions' with the analysis of each well conducted on a separate sheet.

- The report is to be short (600 words + 20% tolerance) and written in a manner that can be understood by a person with a basic understanding of financial analytical tools. It should have the following sections,

o Summary: Brief outline of task, methodology and recommendation.

o Methodology: Explains and justifies the selected evaluation metric.

o Recommendations: Recommends a preferred drilling approach and provides insight into why one drilling approach creates more value than another.

o Limitations: Highlights the key limitations with the analysis and recommends additional analysis to alleviate these limitations where appropriate.

https://www.dropbox.com/s/zxadutiwtov713y/eva-600.rar?dl=0