Reference no: EM1321021

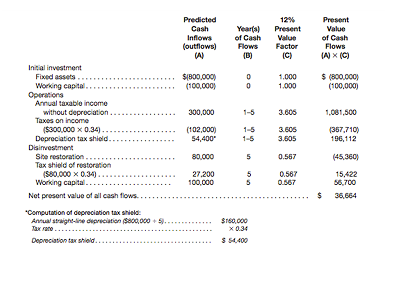

In 2010, the Bayside Chemical Company prepared the following analysis of an investment proposal for a new manufacturing facility:

Because the proposal had a positive net present value when discounted at Bayside's cost of capital of 12 percent, the project was approved; all investments were made at the end of 2011. Shortly after production began in January 2012, a government agency noticed Bayside of required additional expenditures totaling $200,000 to bring the plant into compliance with new federal emission regulations. Bayside has the option either to comply with the regulations by December 31, 2012, or to sell the entire operation fixed assets and working capital) for $250,000 on December 31, 2012. The improvements will be depreciated over the remaining four-year life of the plant using straight-line depreciation. The cost of site restoration will not be affected by the improvements. If Bayside elects to sell the plant, any book loss can be treated as an offset against taxable income on other operations. This tax reduction is an additional cash benefit of selling.

Required

a. Should Bayside sell the plant or comply with the new federal regulations? To simplify calculations, assume that any additional improvements are paid for on December 31, 2012.

b. Would Bayside have accepted the proposal in 2011 if it had been aware of the forthcoming federal regulations?

c. Do you have any suggestions that might increase the project's net present value? (No calculations are required.)

|

Run a multiple linear regression

: Run a multiple linear regression of your selecting & interpret.

|

|

Create an indicator variable for identical twin

: Create an indicator variable for identical twin.

|

|

Compare the path of economic growth

: Compare the path of economic growth using GDP, GDP growth, and GDP per capita. Compare the evolution of Agriculture and Manufacture as components of GDP.

|

|

Background information on the firm

: The Shocking Demise of Mr. Thorndike, Prepare a PowerPoint presentation to be presented in class (blackboard) and an Excel worksheet backup that address the case study question(s) and provides:

|

|

Project’s net present value

: In 2010, the Bayside Chemical Company prepared the following analysis of an investment proposal for a new manufacturing facility: . Do you have any suggestions that might increase the project’s net present value? (No calculations are required.)

|

|

Data storage

: Realize business and organizational data storage and fast access times are much more important than they have ever been. Compare and contrast magnetic tapes, magnetic disks, optical discs, Flash RAM, and solid-state drives

|

|

Application development and programming languages

: Compare and contrast object-oriented languages (Java, C++, C#, etc.) to imperative languages (C, Pascal, etc.) in terms of: Programmability, Maintainability, Performance, Development tools

|

|

Managerial accounting case

: ACT 6691, Managerial Accounting Case: - Read the case and analyze the information. Prepare a narrative report (or notes to the income statement) addressing why/how quantitative items were selected. The following items must be explained:

|

|

What rc4 key value will completely invert s

: What RC4 key value will completely invert S after the initial permutation (so that S[0] = 255, S[1] = 254, ..., S[254] = 1, S[255] = 0)? Show your work. (Explain how you got this.)

|