Reference no: EM131035874

PROJECT AND RISK ANALYSIS As a financial analyst, you must evaluate a proposed project to produce printer cartridges. The equipment would cost $55,000, plus $10,000 for installation. Annual sales would be 4,000 units at a price of $50 per cartridge, and the project's life would be 3 years. Current assets would increase by $5,000 and payables by $3,000. At the end of 3 years the equipment could be sold for $10,000. Depreciation would be based on the MACRS 3-year class, so the applicable rates would be 33%, 45%, 15%, and 7%. Variable costs would be 70% of sales revenues, fixed costs excluding depreciation would be $30,000 per year, the marginal tax rate is 40%, and the corporate WACC is 11%.

a. What is the required investment, that is, the Year 0 project cash flow?

b. What are the annual depreciation charges?

c. What are the project's annual cash flows?

d. If the project is of average risk, what is its NPV? Should it be accepted?

e. Management is uncertain about the exact unit sales. What would the project's NPV be if unit sales turned out to be 20% below forecast but other inputs were as forecasted? Would this change the decision? Explain.

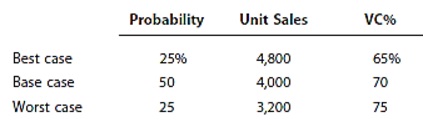

f. The CFO asks you to do a scenario analysis using these inputs:

Other variables are unchanged. What are the expected NPV, its standard deviation, and the coefficient of variation?

g. The firm's project CVs generally range from 1 0 to 1 5. A 3% risk premium is added to the WACC if the initial CV exceeds 1 5, and the WACC is reduced by 0 5% if the CV is 0 75 or less. Then a revised NPV is calculated. What WACC should be used for this project when project risk has been properly considered? What are the revised values for the NPV, standard deviation, and coefficient of variation? Would you recommend that the project be accepted? Why or why not?

|

How can ngos and governments work together

: Is the proliferation of nongovernmental organizations the result of an incapacity on the part of governments? Or, are NGOs an innovation in human social organization and an important step forward for addressing global and local challenges?

|

|

Plot the rate of heat supplied as function final temperature

: Water vapor (H2O) is heated during a steady-flow process at 1 atm from 298 to 3000 K at a rate of 0.2 kg/min. Determine the rate of heat supply needed during this process, assuming (a) some H2O dissociates into H2, O2, and OH and (b) no dissociati..

|

|

How his salary and investment income would be taxed

: HI6028 Taxation, Theory, Practice & Law. Kit is a permanent resident of Australia. He was born in Chile and retains his Chilean citizenship. Kit spends most of the year working off the coast of Indonesia on an oil rig for a United States company. D..

|

|

How should we regulate acceptable modifications

: What changes in what it means to be a human do you foresee in the next 100 years - How will these changes be both good and bad for the individual, community, country, and world?

|

|

Project and risk analysis

: PROJECT AND RISK ANALYSIS As a financial analyst, you must evaluate a proposed project to produce printer cartridges. The equipment would cost $55,000, plus $10,000 for installation. Annual sales would be 4,000 units at a price of $50 per cartridg..

|

|

Compare president bushs claim with dave koehlers position

: Compare and contrast former President Bush's claim that Iraq was a threat to world peace with Dave Koehler's position on the issue.

|

|

Determine the adiabatic flame temperature of the products

: Plot the adiabatic flame temperature and kmoles of CO2, CO, and NO at equilibrium for values of percent excess air between 10 and 100 percent.

|

|

Discuss your rationale for the interventions identified

: Identify, prioritize, and describe at least one problem. ( Write on Constipation) and Provide substantiating evidence (assessment data) for the problem identified.

|

|

Incremental cash flow-sunk cost

: a. Incremental cash flow; sunk cost; opportunity cost; externality; cannibalization. b. Stand-alone risk; corporate (within-firm) risk; market (beta) risk

|