Reference no: EM13168916

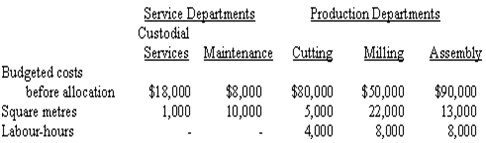

1. Delta Manufacturing Company has two Service Departments-Custodial Services and Maintenance-and three Production Departments-Cutting, Milling, and Assembly. Delta allocates the cost of Custodial Services on the basis of square metres and Maintenance on the basis of labour hours. Budgeted operating data for the year just completed follow:

Required:

a) Prepare a schedule to allocate Service Department costs to the Production Departments by the direct method, rounding all dollar amounts to the nearest whole dollar.

b) Prepare a schedule to allocate Service Department costs to the Production Departments by the step-down method, allocating Custodial Services first, and rounding all amounts to the nearest whole dollar.

2. Mateo Company's average cost per unit is $1.425 at the 16,000-unit level of activity and $1.38 at the 20,000-unit level of activity.Note: you need to calculate a total cost

Assume that all of the activity levels mentioned in this problem are within the relevant range.

Required: Predict the following items for Mateo Company:

a) Variable cost per unit.

b) Total fixed cost per period.

c) Total expected costs at the 18,000-unit level of activity.

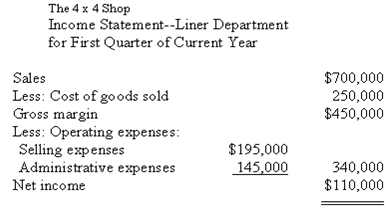

3. The 4 x 4 Shop is a large retailer of equipment for pickup trucks. An income statement for the company's Bed Liner Department for the most recent quarter is presented below:

The liners sell, on average, for $350 each. The department's variable selling expenses are $35 per liner sold. The remaining selling expenses are fixed. The administrative expenses are 25% variable and 75% fixed. The company purchases its liners from a supplier at a cost of $125 per liner.

Required: Prepare an income statement for the quarter, using the contribution approach.

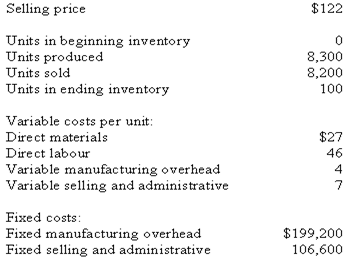

Q4.) Mahugh Company, which has only one product, has provided the following data concerning its most recent month of operations:

For you to answer:

a) What is the unit product cost for the month under variable costing?

b) What is the unit product cost for the month under absorption costing?

c) Prepare an income statement for the month using the contribution format and the variable costing method.

d) Prepare an income statement for the month using the absorption costing method.

e) Reconcile the variable costing and absorption costing operating incomes for the month.