Reference no: EM131599181

Problem - Worksheet, direct and indirect holding, intercompany merchandise, machine

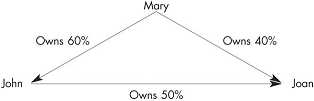

The following diagram depicts the relationships among Mary Company, John Company, and Joan Company on December 31, 2018:

Mary Company purchases its interest in John Company on January 1, 2016, for $204,000. John Company purchases its interest in Joan Company on January 1, 2017, for $75,000. Mary Company purchases its interest in Joan Company on January 1, 2018, for $72,000. All investments are accounted for under the equity method. Control over Joan Company does not occur until the January 1, 2018, acquisition. Thus, a D&D schedule will be prepared for the investment in Joan as of January 1, 2018.

The following stockholders' equities are available:

|

John Company December 31,

|

Joan Company December 31,

|

|

2015

|

2016

|

2017

|

|

Common stock ($10 par)

|

$150,000

|

|

|

|

Common stock ($10 par)

|

|

$100,000

|

$100,000

|

|

Paid-in capital in excess of par

|

75,000

|

|

|

|

Retained earnings

|

75,000

|

50,000

|

80,000

|

|

Total equity

|

$300,000

|

$150,000

|

$180,000

|

On January 2, 2018, Joan Company sells a machine to Mary Company for $20,000. The machine has a book value of $10,000, with an estimated life of five years and is being depreciated on a straight-line basis.

John Company sells $20,000 of merchandise to Joan Company during 2018 to realize a gross profit of 30%. Of this merchandise, $5,000 remains in Joan Company's December 31, 2018, inventory. Joan owes John $3,000 on December 31, 2018, for merchandise delivered during 2018.

Trial balances of the three companies prepared from general ledger account balances on December 31, 2018, are as follows:

|

Mary Company

|

John Company

|

Joan Company

|

|

Cash

|

62,500

|

60,000

|

30,000

|

|

Accounts Receivable

|

200,000

|

55,000

|

30,000

|

|

Inventory

|

360,000

|

80,000

|

50,000

|

|

Investment in John Company

|

270,000

|

|

|

|

Investment in Joan Company

|

86,000

|

107,500

|

|

|

Property, Plant, and Equipment

|

2,250,000

|

850,000

|

350,000

|

|

Accumulated Depreciation

|

(938,000)

|

(377,500)

|

(121,800)

|

|

Intangibles

|

15,000

|

|

|

|

Accounts Payable

|

(215,500)

|

(61,000)

|

(22,000)

|

|

Accrued Expenses

|

(12,000)

|

(4,000)

|

(1,200)

|

|

Bonds Payable

|

(500,000)

|

(300,000)

|

(100,000)

|

|

Common Stock ($5 par)

|

(500,000)

|

|

|

|

Common Stock ($10 par)

|

|

(150,000)

|

|

|

Common Stock ($10 par)

|

|

|

(100,000)

|

|

Paid-In Capital in Excess of Par

|

(700,000)

|

(75,000)

|

|

|

Retained Earnings, January 1, 2018

|

(290,000)

|

(130,000)

|

(80,000)

|

|

Sales

|

(1,800,000)

|

(500,000)

|

(300,000)

|

|

Gain on Sale of Equipment

|

|

|

(10,000)

|

|

Subsidiary Income

|

(58,000)

|

(20,000)

|

|

|

Cost of Goods Sold

|

1,170,000

|

350,000

|

180,000

|

|

Other Expenses

|

525,000

|

100,000

|

90,000

|

|

Dividends Declared

|

75,000

|

15,000

|

5,000

|

|

Totals

|

0

|

0

|

0

|

Required - Prepare the worksheet necessary to produce the consolidated financial statements of Mary Company and its subsidiaries as of December 31, 2018. Include the determination and distribution of excess and income distribution schedules. Any excess of cost is assumed to be attributable to goodwill.