Reference no: EM131626964

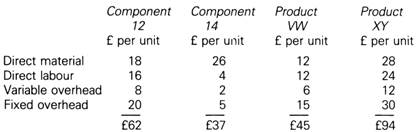

Question: The management of an engineering company manufacturing a range of products is considering next year's production, purchase and sales budgets. Shown below are the budgeted total unit costs for two of the components and two of the products manufactured by the company.

Components 12 and 14 are incorporated into other products manufactured and sold by the company, but not the two products shown above. it is possible to purchase Components 12 and 14 from another company for £60 per unit and £30 per unit respectively. The anticipated selling prices of Products VW and XY are £33 and £85 respectively.

Required: (a) Advise the management of the company whether it would be profitable to :

(i) purchase either of the above components,

(ii) sell either of the above products.

(b) State clearly, and where appropriate comment upon, the assumptions you have made in answering (a) above.

(c) Consider how the following additional information would affect your advice in (a) above:

(i) Next year's budgeted production requirements for the two components are 7,000 units of Component 12 and 6,000 units of Component 14. Next year's budgeted sales for the two products are Product VW 5,000 units and Product XY 4,000 units.

(ii) A special machine is used exclusively by the above two component s and two products and for technical reasons the machine can only be allowed to operate for 80,000 machine hours next year. The budgeted usage of the machine is:

Component 12 - 8 machine hours Component 14 - 2 machine hours Product VW - 6 machine hours Product XY - 12 machine hours The operating costs of the machine have been included in the unit costs shown in (a) above.