Reference no: EM13375139

Problem 1:

Additional facts:

The taxpayer exchanges property in 2010 with a fair market value of $5,500,000 that has a basis of $750,000. The property is also subject to a mortgage of $2,500,000. The taxpayer receives like-kind replacement property with a value of $6,500,000 that is subject to a mortgage of $1,000,000. In order to balance the equities in the exchange, the taxpayer contributes additional funds as needed.

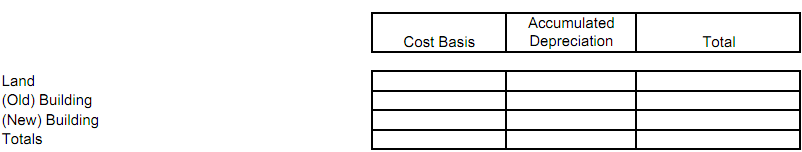

Adjusted basis of the relinquished property is composed of the following amounts:

The fair market value of the land and building of the replacement property are as follows:

Answer the following questions:

a) How much is the realized gain?

b) How much is the total boot, if any?

c) Is there mortgage boot? If so, how much?

d) How much new money was contributed by the taxpayer to balance the equities?

e) What is the total basis of the like-kind property received?

f) Provide the following basis* items immediately after the exchange for the like-kind property received:

Problem 2:

Answer the following questions:

How much is the realized gain?

How much is the total boot, if any?

Is there mortgage boot? If so, how much?

How much boot will be recognized in the following periods, if any?

The taxpayer exchanges property in 2010 with a fair market value of $5,500,000 that has a basis of $750,000. The property is also subject to a mortgage of $2,500,000. The taxpayer receives like-kind replacement property with a value of $3,000,000 that is subject to a mortgage of $1,000,000. In order to balance the equities in the exchange, the taxpayer receives an installment note in the amount of $1,000,000. The installment note payments will be received in two $500,000 installments with the first being paid in 2011 and the latter in 2012 (ignore interest rules for purposes of the problem).

2010

2011

2012

What is the basis in the like-kind property received?

What is the basis in the not like-kind property received (the installment note)?