Reference no: EM131975

A non-parent entity, L Ltd, acquired on 1 July 2010 a 21% voting interest in P Ltd for $190,000 cash. The recorded identifiable net assets and assumed liabilities of P Ltd as at the date of acquisition were represented by the following equity items:

Issued capital $231,000

Retained earnings $166,070

Total equity

At the date of acquisition, all of the identifiable assets and liabilities of P Ltd were stated in the accounts at fair value except for plant and equipment which was carried at $230,000 and had a fair value of $351,000. At this date it was considered to have a further working life of 5 years.

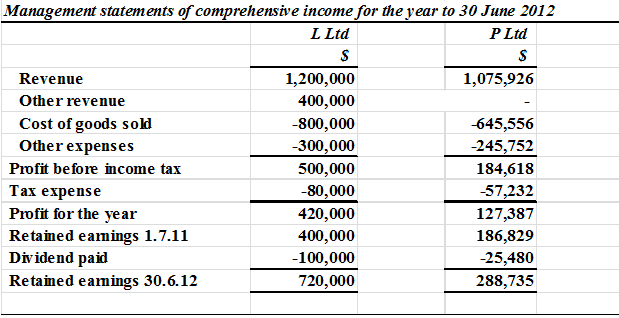

The following information has been extracted from the management accounts for both entities for 30 June 2012:

|

Management statements of financial position as at 30 June 2012

|

|

L Ltd

|

|

P Ltd

|

|

$

|

|

$

|

|

Assets

|

|

|

|

|

Current assets

|

|

|

|

|

Inventories

|

500,000

|

|

607,361

|

|

Other current assets

|

1,150,000

|

|

1,016,727

|

|

Non current assets

|

|

|

|

|

Investment in associates

|

200,000

|

|

-

|

|

Property, plant and equipment

|

800,000

|

|

650,000

|

|

Accumulated depreciation - ppe

|

-140,000

|

|

-80,000

|

|

Total assets

|

2,510,000

|

|

2,194,088

|

|

Current liabilities

|

|

|

|

|

Trade and other payables

|

850,000

|

|

1,544,353

|

|

Total liabilities

|

850,000

|

|

1,544,353

|

|

Net assets

|

1,660,000

|

|

649,735

|

|

Shareholders' equity

|

|

|

|

|

Issued capital

|

600,000

|

|

231,000

|

|

Revaluation surplus

|

340,000

|

|

130,000

|

|

Retained earnings

|

720,000

|

|

288,735

|

|

Total shareholders' equity

|

1,660,000

|

|

649,735

|

Additional information

1 On 30 June 2012 L Ltd carried inventory sold to it by P Ltd at a mark-up of $49,365.

2 On 30 June 2011 L Ltd had carried inventory sold to it by P Ltd at a mark-up of $66,481. The entire inventory had subsequently been sold.

3 L Ltd has not recognized an impairment loss in relation to its investment in P Ltd in its financial statements for the year ended 30 June 2012.

4 P Ltd revalued its property plant and equipment on 30 June 2012.

5 The company tax rate is 30%

Required:

Apply the equity method to L's investment in P Ltd. Prepare the statement of comprehensive income, changes in equity, financial position and any other relevant disclosures for the notes to the financial statement of L Ltd as required by AASB 128 for the year ended 30 June 2012.

Q2

On 1 July 2006 ABC Ltd acquired 75% of the share capital in XYZ Ltd for $150,000 cash. In addition to the cost of the shares ABC Ltd paid valuation fees associated with the acquisition of $6,000. At acquisition date the equity of XYZ Ltd consisted of:

|

Share capital

|

$90,000

|

|

General reserve

|

10,000

|

|

Retained earnings

|

20,000

|

All the assets and liabilities of XYZ Ltd at the date of acquisition were recorded at fair value other than the following:

|

|

Carrying amount

|

Fair value

|

|

Plant (Cost $92,000)

|

$60,000

|

85,000

|

|

Land

|

40,000

|

75,000

|

|

Contingent liability

|

0

|

12,000

|

All fair value adjustments are recorded on consolidation. The plant has a remaining useful life of 8 years. The revalued land was sold outside the group on 1 July 2007 for $85,000. The contingent liability was settled for $12,000 on 1 December 2006. The tax rate is 30%.

ABC Ltd uses the full goodwill method. The value of the non-controlling interest has been estimated at $50,000.

Other information:

a) The inventory of XYZ Ltd on 1 July 2009 included inventory purchased from ABC Ltd for $5,000. The original cost of the inventory was $17,000. The inventory was not considered impaired at the time of the sale by ABC Ltd. The inventory was sold outside the group in September 2009.

b) The inventory of ABC Ltd on 1 July 2009 included inventory purchased from XYZ Ltd for $5,000 above cost. The inventory was sold outside the group in December 2009.

c) ABC Ltd sold inventory to XYZ Ltd on 1 February 2010 for $15,000. The original cost of the inventory was $8,000. The inventory had been entirely sold outside the group by 30 June 2010.

d) XYZ Ltd sold inventory to ABC Ltd for $25,000 on 1 June 2010. The sale price represented a mark-up of 25% on cost. By 30 June 2010 ABC Ltd had sold 90% of this inventory outside the group.

e) On 1 July 2008 XYZ Ltd sold an item of plant to ABC Ltd for $10,000. The carrying amount at the time of sale was $15,000 (cost was $25,000). At the time of the sale the asset had a remaining useful life of 10 years.

f) ABC Ltd charged XYZ Ltd a management fee of $12,000 for the current financial year.

g) On 30 June 2010 XYZ Ltd owes ABC Ltd $20,000. XYZ Ltd paid $500 to ABC Ltd in interest on 30 June 2010.

h) Goodwill on acquisition is not considered impaired.

Required

1) Prepare an acquisition analysis.

2) Prepare all necessary consolidation adjustment entries needed to prepare the consolidated financial statements as at 30 June 2010. The balance sheets and income statement of ABC Ltd and XYZ Ltd can be found on the worksheet below.

3) Using the adjustments you prepared in 2) complete the worksheet as at 30 June 2010.

4) Prepare the disclosures of the NCI in profit and equity for the year ended 30 June 2010.

|

|

ABC

Ltd

|

XYZ

Ltd

|

Adjustments

|

Group

Data

|

|

Debit

|

Credit

|

|

Sales revenue

|

$1,200,000

|

$125,000

|

|

|

|

|

Cost of goods sold

|

850,000

|

55,000

|

|

|

|

|

Gross profit

|

$350,000

|

$70,000

|

|

|

|

|

Add dividend revenue

|

7,500

|

0

|

|

|

|

|

Add interest revenue

|

600

|

0

|

|

|

|

|

Add management fee

|

12,000

|

0

|

|

|

|

|

Add: Gain on sale of plant

|

0

|

1,000

|

|

|

|

|

Less depreciation expense

|

15,000

|

9,000

|

|

|

|

|

Less interest expense

|

25,000

|

1,000

|

|

|

|

|

Less other expenses

|

150,100

|

13,000

|

|

|

|

|

Profit before tax

|

180,000

|

48,000

|

|

|

|

|

Less income tax expense

|

50,000

|

11,700

|

|

|

|

|

Profit for the year

|

130,000

|

36,300

|

|

|

|

|

Add retained earnings July 1 2009

|

120,000

|

22,000

|

|

|

|

|

Less dividends paid

|

15,000

|

5,000

|

|

|

|

|

Less dividends declared

|

20,000

|

5,000

|

|

|

|

|

Retained earnings June 30 2010

|

215,000

|

48,300

|

|

|

|

|

General reserve

|

50,000

|

10,000

|

|

|

|

|

Share capital

|

240,000

|

90,000

|

|

|

|

|

NCI equity (goodwill)

|

0

|

0

|

|

|

|

|

Fair value adjustment

|

0

|

0

|

|

|

|

|

Shareholders' equity

|

505,000

|

148,300

|

|

|

|

|

|

====

|

====

|

|

|

|

|

Assets

|

|

|

|

|

|

|

Cash

|

60,000

|

49,000

|

|

|

|

|

Accounts receivable

|

102,000

|

29,000

|

|

|

|

|

Inventory

|

73,000

|

40,000

|

|

|

|

|

Dividend receivable

|

7,500

|

0

|

|

|

|

|

Investment in XYZ

|

150,000

|

0

|

|

|

|

|

Land

|

130,000

|

57,000

|

|

|

|

|

Plant

|

245,000

|

147,000

|

|

|

|

|

Accumulated depreciation

|

-108,000

|

-80,000

|

|

|

|

|

Goodwill

|

|

|

|

|

|

|

Loan receivable

|

88,500

|

0

|

|

|

|

|

Deferred tax asset

|

75,000

|

30,000

|

|

|

|

|

Total assets

|

823,000

|

272,000

|

|

|

|

|

Less liabilities

|

|

|

|

|

|

|

Accounts payable

|

75,000

|

6,700

|

|

|

|

|

Dividend payable

|

15,000

|

5,000

|

|

|

|

|

Tax payable

|

25,000

|

7,000

|

|

|

|

|

Loans payable

|

200,000

|

100,000

|

|

|

|

|

Deferred tax liabilities

|

3000

|

5,000

|

|

|

|

|

Net assets

|

505,000

|

148,300

|

|

|

|