Reference no: EM132525807

HI5001 Accounting for Business Decisions - Holmes Institute

Purpose: This assignment is designed to assess your level of knowledge of the key topics covered in this unit

Learning Outcomes 1: Analyze how various transactions will affect the accounting equation, the balance sheet, and the income statement and communicate this to a range of stakeholders;

Learning Outcomes 2. Apply, analyze, synthesize and evaluate information from multiple sources to make decisions about the financial performance of entities including assets, liabilities, owner's equity, revenue and expenses;

Learning Outcomes 3. Employ information technologies to analyze transaction data and financial statement to facilitate data-driven decision-making;

Learning Outcomes 4. Assess the impact of taxation and other liabilities, relevant legislation and industry codes of practice on business and define management strategies.

Part 1

Evaluate the statement "Accounting is all about numbers.". Using the definition of accounting to justify your answer. (maximum 250 words)

Part 2

Financial data for Safety Hire as of 30 June 2019 are:

Required:

Prepare an income statement for the month of June and a balance sheet in account format for Safety Hire as at 30 June 2019. (10 marks)

Part 3

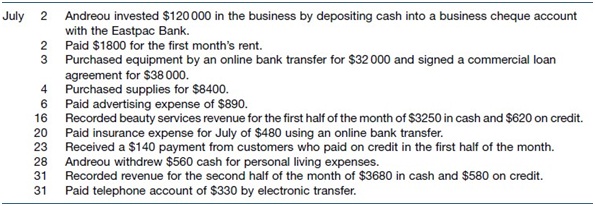

On 1 July 2018 Nicole Andreou opened a beauty parlour. The following transactions occurred during the first month of operations (ignore GST).

Use the following account titles and numbers: Cash at Bank, 100; Accounts Receivable, 101; Supplies, 102; Equipment, 103; Loan Payable, 200; Nicole Andreou, Capital, 300; Nicole Andreou,

Drawings, 301; Revenue, 400; Rent Expense, 500; Advertising Expense, 501; Insurance Expense, 502;

Telephone Expense, 503.

Required:

a) Prepare the general journal entries to record the above transactions.

b) Post the entries from the general journal to the general ledger accounts (running balance format) and enter the posting references in the general journal.

c) Prepare a trial balance as at 31 July 2018.

Part 4

The financial year for Drip Dry Cleaning Services ends on 30 June. Using the following information, make the necessary adjusting entries at year-end. Ignore GST. Ignore Narration.

1. On 15 February, Danielle Drip's business borrowed $16 000 from Northern Bank at 8% interest. The principal and interest are payable on 15 August.

2. Drip Dry Cleaning Services purchased a 1-year insurance policy on 1 March of the current year for

$660. A 3-year policy was purchased on 1 November of the previous year for $2700. Both purchases were recorded by debiting Prepaid Insurance.

3. The business has two part-time employees who each earn $220 a day. They both worked the last 3 days in June for which they have not yet been paid.

4. On 1 June, the Highup Hotel paid the business $2100 in advance for doing their dry cleaning for the next 3 months. This was recorded by a credit to Unearned Dry Cleaning Revenue.

5. The supplies account had a $280 debit balance on 1 July. Supplies of $1560 were purchased during the year and $190 of supplies are on hand as at 30 June.

Required:

Prepare the necessary adjusting entries at 30 June.

Part 5

The adjusted trial balance columns in the worksheet of Elliot Painting Services are as follows.

ELLIOT PAINTING SERVICES

Worksheet (Partial)

for the year ended 30 June 2019

|

Account

|

Adjusted trial balance

|

Income statement

|

Balance sheet

|

|

Debit

|

Credit

|

Debit

|

Credit

|

Debit

|

Credit

|

|

Cash at Bank

|

1 230

|

|

|

|

|

|

|

Accounts Receivable

|

75 600

|

|

|

|

|

|

|

Prepaid Rent

|

1 800

|

|

|

|

|

|

|

Office Supplies

|

8 320

|

|

|

|

|

|

|

Equipment

|

160 000

|

|

|

|

|

|

|

Accum. Depr. Equip't

|

|

25 000

|

|

|

|

|

|

Accounts Payable

|

|

54 000

|

|

|

|

|

|

Salaries Payable

|

|

8 760

|

|

|

|

|

|

Unearned Revenue

|

|

3 430

|

|

|

|

|

|

F. Elliot, Capital

|

|

101 500

|

|

|

|

|

|

F. Elliot, Drawings

|

22 000

|

|

|

|

|

|

|

Painting Revenue

|

|

219 650

|

|

|

|

|

|

Salaries Expense

|

106 000

|

|

|

|

|

|

|

Rent Expense

|

6 050

|

|

|

|

|

|

|

Depreciation Expense

|

8 040

|

|

|

|

|

|

|

Telephone Expense

|

4 020

|

|

|

|

|

|

|

Office Supplies Used

|

10 080

|

|

|

|

|

|

|

Sundry Expenses

|

9 200

|

|

|

|

|

|

|

Profit for the period

|

$412 340

|

$412 340

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Required:

a) Complete the worksheet.

b) Prepare the closing entries necessary at 30 June 2019, assuming that this date is the end of the entity's accounting period.

Attachment:- Accounting for Business Decisions.rar