Reference no: EM132893642

Exercise

Impairment of an individual asset

On 1 July 2020 an item of equipment is acquired at a cost of $3 million. The asset is to be de- preciated using the straight-line method on the basis of an estimated useful life of 15 years and a negligible residual value.

On 30 June 2022 it is determined that the asset has a value in use of $2 million and a fair value of $1.8 million before costs of disposal of $50 000. The remaining useful life of the asset is re- assessed to be 8 years.

On 30 June 2023 it is determined that the asset has a value in use of $1.2 million and a fair value of $1.1 million before costs of disposal of $50 000. The remaining useful life of the asset is reassessed to be 5 years.

Required

Prepare the journal entries for any depreciation and impairment adjustments on the follow- ing dates.

1. 30 June 2021

2. 30 June 2022

3. 30 June 2023

4. 30 June 2024

1. 30 June 2021:

DR Depreciation - Equipment

Exercise 2 Impairment of a CGU

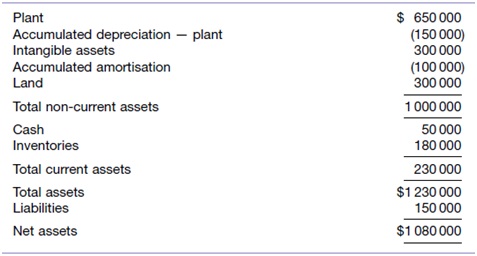

Spear Ltd reported the following information in its statement of financial position at 30 June 2019.

At 30 June 2019, Spear Ltd analysed the internal and external sources of information that would indicate deterioration in the worth of its assets. It determined that there were indica- tions of impairment.

Spear Ltd calculated the recoverable amount of the assets to be $980 000. Required

Provide the journal entry for any impairment loss at 30 June 2019.

Exercise 3:

Impairment of CGU, goodwill

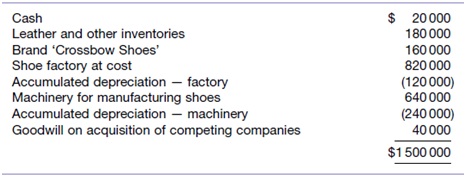

Crossbow Ltd is an entity that specialises in the manufacture of leather footwear for women. It has aggressively undertaken a strategy of buying out other companies that had competing products. These companies were liquidated and the assets and liabilities brought into Cross- bow Ltd.

At 30 June 2019, Crossbow Ltd reported the following assets in its statement of financial posi- tion.

In response to competition from overseas, as customers increasingly buy online rather than visit Crossbow Ltd's stores, Crossbow Ltd assessed its impairment position at 30 June 2019. The indicators suggested that an impairment loss was probable. Crossbow Ltd calculated a recoverable amount of its company of $1 420 000.

Required

Prepare the journal entry(ies) for any impairment loss occurring at 30 June 2019.