Reference no: EM13950823

Listed below are the transactions that affected the shareholder's equity of BLT Corporation during the period 2010-2012. At December 31, 2009, the corporation's accounts included:

Common stock, 315 million shares at $1 par..... $ 315,000,000

Paid in capital excess of par............. $ 1,890,000

Retained earnings.................. $ 2,910,000

a. November 2, 2010, the board of directors declared a cash dividend of $0.80 per share on its common shares, payable to shareholders of record November 16, to be paid December 2.

b. On March 2, 2011, the board of directors declared a property dividend consisting of corporate bonds of Blair County that BLT was holding as an investment. The bonds had a fair market value of $4.8 million, but were purchased two years previously for $3.9 million. Because they were intended to be held to maturity, the bonds had not been previously written up. The property dividend was payable to shareholders of record March 14, to be distributed April 6.

c. On July 13, 2011, the corporation declared and distributed a 5% common stock dividend (when the market value of the common stock was $21 per share).

d. On November 2, 2011, the board of directors declared a cash dividend of $0.80 per share on its common shares, payable to shareholders of record November 16, to be paid December 2.

e. On January 16, 2012, the board of directors declared and distributed 50% stock dividend when the market value of the common stock was $23 per share.

f. On November 2, 2012, the board of directors declared a cash dividend of $0.65 per share on its common shares, payable to shareholders of record November 16, to be paid December 2.

Required:

1. Prepare the journal entries that BLT recorded during the three-year period for these transactions. SHOW ALL WORK(Bench-mark figures below)

Decreases to Retained Earnings

2010............252,000,000

2011............600,150,000

2012............487,856,000

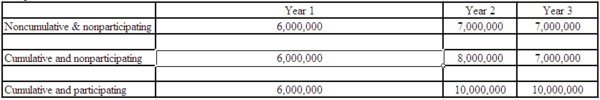

Chapter 15 Preferred and Common Cash Dividends:

|

What is the importance of bandwidth

: What would the Web be like if there were no limit to bandwidth?

|

|

Define what is part of the project

: Discuss the statement: Failing to define what is not part of the project is just as important as failing to define what is part of the project.

|

|

Sales promotions are expensive to administer

: Sales promotions are expensive to administer and can be fraught with legal complications. Sales promotions yield their most positive results when carefully integrated with the overall advertising plan. Identify which of the sales promotion techniques..

|

|

International competitors within the chosen industry

: Select one (1) global industry, such as the automobile or cell phone industry. Next, use the Internet to research three (3) major international competitors within the chosen industry. Take note of manner in which the popular international business..

|

|

Prepare the journal entries that blt recorded

: On November 2, 2012, the board of directors declared a cash dividend of $0.65 per share on its common shares, payable to shareholders of record November 16, to be paid December 2.

|

|

Select a template to explore. what was its purpose

: What would be an advantage of using this template over creating your presentation from scratch? What would be a disadvantage?

|

|

Describe posttraumatic stress disorder

: Describe posttraumatic stress disorder (PTSD). Identify some of the biological, psychological, and social factors associated with the disorder. Briefly discuss how PTSD could treated using the psychological, biomedical and social approaches descri..

|

|

Projected ROEs between the restricted and relaxed policie

: Edwards Enterprises follows a moderate current asset investment policy, but it is now considering a change, perhaps to a restricted or maybe to a relaxed policy. The firm’s annual sales are $400,000; its fixed assets are $100,000; What is the differe..

|

|

The dividends are expected to grow at a constant rate

: Heard, Inc. just paid a dividend of $1.75 per share on its stock (that is, Div0 = $1.75). The dividends are expected to grow at a constant rate of 6 percent per year, indefinitely. If investors require a 12 percent return on Heard stock, what is the ..

|