Reference no: EM132892565

Application and analysis questions

Exercise 1

Revaluation adjustments and reversals

On 1 January 2019, Lima Ltd revalued land from $100 000 to $200 000. On 1 January 2020, the company subsequently revalued the land to $160 000. And on 1 January 2021, the compa- ny again revalued the asset downwards to $80 000.

Required

1. Prepare the journal entries required to record the revaluation adjustment for the year ended 30 June 2019.

2. Prepare the journal entries required to record the revaluation adjustment for the year ended 30 June 2020.

3. Prepare the journal entries required to record the revaluation adjustment for the year ended 30 June 2021.

Exercise 2

Revaluation adjustments and reversals

The following data from Lyre Ltd's accounts relates to two assets at 30 June 2018:

At 30 June 2018 Lyre Ltd decides to adopt the revaluation model for both these assets. On this date land has a fair value of $1 500 000 and plant and equipment has a fair value of $220 000 (the remaining useful life is 5 years). On 30 June 2019 Lyre Ltd reviews the value of its assets. The fair value of land is reassessed as $1 550 000. Plant and equipment has no change in value on that date.

Required

Prepare the journal entries required to revalue the assets for the year ended 30 June 2018 and the 30 June 2019.

Exercise 3

Depreciation and revaluation of assets

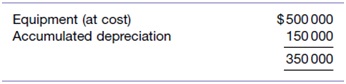

In the annual report of Emu Ltd, the equipment was reported as follows:

The equipment consisted of two machines, Machine A and Machine B. Machine A had cost

$300 000 and had a carrying amount of $180 000 at 30 June 2019, and Machine B had cost

$200 000 and had a carrying amount of $170 000. Both machines are measured using the cost model, and depreciated on a straight-line basis over a 10-year period.

On 31 December 2019, the directors of Emu Ltd decided to change the basis of measuring the equipment from the cost model to the revaluation model. Machine A was revalued to $180 000 with an expected useful life of 6 years, and Machine B was revalued to $155 000 with an ex- pected useful life of 5 years.

At 1 July 2020, Machine A was assessed to have a fair value of $163 000 with an expected use- ful life of 5 years, and Machine B's fair value was $136 500 with an expected useful life of 4 years.

Required

1. Prepare the journal entries for Machine A for the period 1 July 2019 to 30 June 2020 on the basis that it was revalued on 31 December 2019.

2. Prepare the journal entries for Machine B for the period 1 July 2019 to 30 June 2020 on the basis that it was revalued on 31 December 2019.

3. Prepare the revaluation journal entries required for 1 July 2020.

4. According to accounting standards, on what basis may management change the method of asset measurement, for example from cost to fair value?