Reference no: EM132893682

Exercise 1

Acquisition analysis, acquisition date entries

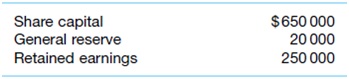

On 1 July 2019, Christina Ltd acquired all the issued shares of Adeline Ltd, paying $120 000 cash and transferring 100 000 of its own shares to Adeline Ltd's former shareholders. At that date, the financial statements of Adeline Ltd showed the following information.

All the assets and liabilities of Adeline Ltd were recorded at amounts equal to their fair values at the acquisition date. The fair value of Christina Ltd's shares at acquisition date was $2 per share. Christina Ltd incurred $30 000 in acquisition-related costs that included $5000 as

share issue costs.

Required

1. Prepare the acquisition analysis at 1 July 2019.

2. Prepare the journal entries for Christina Ltd to recognise the investment in Adeline Ltd at 1 July 2019.

3. Prepare the consolidation worksheet entries for Christina Ltd's group at 1 July 2019.

Exercise 2

Undervalued and unrecorded assets, unrecorded liabilities On 1 July 2019, Ava Ltd acquired all the issued shares of Isabel Ltd for a cash consideration of $1 000 000. At that date, the financial statements of Isabel Ltd showed the following infor- mation.

All the assets and liabilities of Isabel Ltd were recorded at amounts equal to their fair values at the acquisition date, except some equipment recorded at $50 000 below its fair value with a related accumulated depreciation of $80 000. Also, Ava Ltd identified at acquisition date a contingent liability related to a lawsuit where Isabel Ltd was sued by a former supplier and attached a fair value of $40 000 to that liability.

Required

1. Prepare the acquisition analysis at 1 July 2019.

2. Prepare the consolidation worksheet entries for Ava Ltd's group at 1 July 2019, assuming that Isabel Ltd has not revalued the equipment in its own accounts.

3. Prepare the consolidation worksheet entries for Ava Ltd's group at 1 July 2019, assuming that Isabel Ltd has revalued the equipment in its own accounts.

Exercise 3

Undervalued assets, pre-acquisition reserves transfers

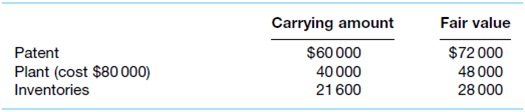

On 1 July 2019, Mutt Ltd acquired all the issued shares of Jeff Ltd for $174 800. At this date the equity of Jeff Ltd consisted of share capital of $80 000 and retained earnings of $68 800. All the identifiable assets and liabilities of Jeff Ltd were recorded at amounts equal to fair value except for:

The patent was considered to have an indefinite life. It was estimated that the plant had a fur- ther life of 10 years, and was depreciated on a straight-line basis. All the inventories were sold by 30 June 2020.

In May 2020, Jeff Ltd transferred $20 000 from the retained earnings on hand at 1 July 2019 to a general reserve. In June 2020, Jeff Ltd conducted an impairment test on the patent and on the goodwill acquired. As a result, the goodwill was considered to be impaired by $1200. The tax rate is 30%.

Required

1. Prepare the acquisition analysis at 1 July 2019.

2. Prepare the consolidation worksheet entries for Mutt Ltd's group at 1 July 2019.

3. Prepare the consolidation worksheet entries for Mutt Ltd's group at 30 June 2020.