Reference no: EM131792331

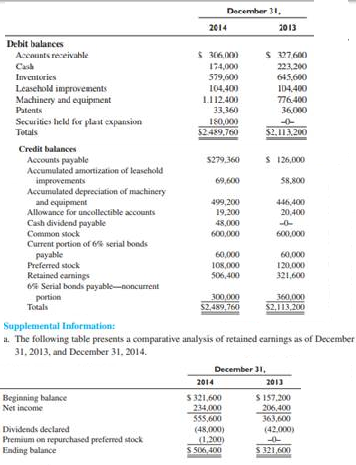

Question: The management of Banciu Corporation provides you with the comparative analysis of changes in account balances between December 21, 2013, and December 31, 2014, appearing below.

b. On December 10, 2014, the board of directors declared a cash dividend of $0.24 per share, payable to holders of common stock on January 10, 2015. c. Purchased new machinery for $463,000. In addition, Banciu sold certain machinery it was no longer using for $57,600. The machinery cost $127,000 and had accumulated depreciation of $53,800 at the date of the sale. Banciu made no other entries in Machinery and equipment or related accounts other than for depreciation.

d. Purchased 120 preferred shares, par value $100, at $110 and subsequently canceled the shares. Banciu debited the premium paid to Retained earnings.

e. Paid $2,400 of legal costs in successful defense of a new patent, which it correctly debited to the Patents account. It recorded patent amortization amounting to $5,040 during the year ended December 31, 2014.

f. During 2014, Banciu wrote off accounts receivable totaling $3,600 as uncollectible.

g. During 2014, Banciu purchased $180,000 of securities that are being held for future plant expansion.

Required: 1. Prepare the entries (in general journal form) that would be entered into T-accounts needed to prepare a statement of cash flows from the data given. For example, the first entry would be

DR Cash(Operations-Net income) $234,000

CR Retained earnings $234,000

2. Prepare a statement of cash flows for Banciu Corporation for 2014. Use the indirect method for presenting cash flow from operations.