Reference no: EM132893748

Exercise 1

Consolidation worksheet entries, multiple subsidiaries, acquisitions on the same date

On 1 July 2018, Canada Ltd acquired 80% of the issued shares of China Ltd and China Ltd acquired 75% of the issued shares of Chile Ltd. All shares were acquired on a cum div. basis.

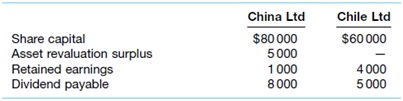

The equity of China Ltd and Chile Ltd at 1 July 2018 consisted of the following items.

At 1 July 2018, all identifiable assets and liabilities of China Ltd and Chile Ltd were recorded at fair value. No goodwill or gain on bargain purchase arose in any of the acquisitions.

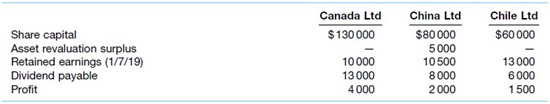

The financial statements of the three companies at 30 June 2020 contained the following information.

The dividends payable refer to dividends declared out of profits for the year ended 30 June 2020.

Since 1 July 2018, the following intragroup transactions have occurred.

(a) China Ltd sold to Chile Ltd an item of machinery for $12 000 on 31 December 2018. The machinery had originally cost China Ltd $14 000 and at the time of sale had been depreci- ated to $11 200. Chile Ltd charges depreciation at 10% p.a. straight-line on this machinery.

(b) During the year ended 30 June 2020, inventories were sold by Chile Ltd to China Ltd at 25% mark-up on cost. Inventories for which China Ltd paid $4000 to Chile Ltd are in- cluded in the inventories of China Ltd as at 30 June 2020. The tax rate is 30%.

Required

Prepare the consolidation worksheet entries for the year ended 30 June 2020.

Exercise 2

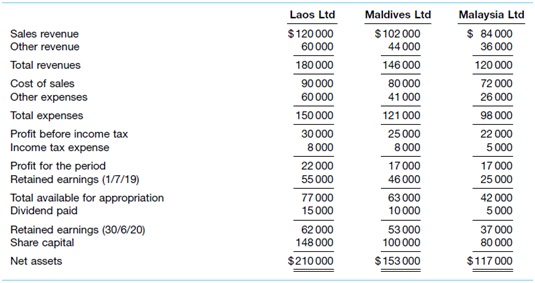

Consolidation worksheet entries, multiple subsidiaries, acquisitions on the same date On 1 July 2017, Laos Ltd acquired 70% of the issued shares of Maldives Ltd for $100 000 and Maldives Ltd acquired 60% of the issued shares of Malaysia Ltd for $70 000. The equity of the companies at 1 July 2017 was as follows.

At 1 July 2017, all the identifiable assets and liabilities of both Maldives Ltd and Malaysia Ltd were recorded at fair value.

At 30 June 2020, the financial data of the three companies were as follows.

Since 1 July 2017, the following transactions have occurred between the three companies.

• On 1 July 2019, Malaysia Ltd sold a motor vehicle to Maldives Ltd for $25 000. The carry- ing amount of the vehicle at the date of sale was $23 000. Vehicles are depreciated at 30%

p.a. on a straight-line basis.

• During the year ended 30 June 2020, Maldives Ltd sold inventories valued at $20 000 to Laos Ltd, this having cost Maldives Ltd $15 000. Half of these inventories are still on hand at 30 June 2020.

The tax rate is 30%.

Required

Prepare the consolidation worksheet journal entries for the year ended 30 June 2020.