Reference no: EM131814998

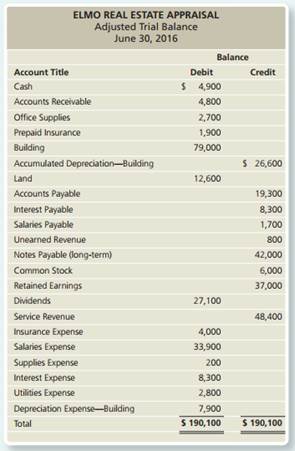

Question: Preparing financial statements including a classified balance sheet in report form, preparing and posting closing entries, and preparing a post-closing trial balance The adjusted trial balance of Elmo Real Estate Appraisal at June 30, 2016, follows:

Requirements: 1. Prepare the company's income statement for the year ended June 30, 2016.

2. Prepare the company's statement of retained earnings for the year ended June 30, 2016.

3. Prepare the company's classified balance sheet in report form at June 30, 2016.

4. Journalize the closing entries.

5. Open the T-accounts using the balances from the adjusted trial balance, and post the closing entries to the T-accounts.

6. Prepare the company's post-closing trial balance at June 30, 2016.