Reference no: EM131821203

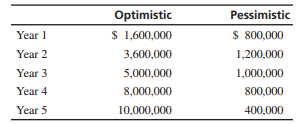

Question: Capital Budgeting, Sensitivity Analysis, and Ethics Abrielle Rossi had recently been appointed controller of the soup division of a major food company. The division manager, Asim Sharma, was known as a hard-driving, intelligent, uncompromising manager. He had been very successful and was rumored to be on the fast track to corporate top management, maybe even in line for the company presidency. One of Abrielle's first assignments was to prepare the financial analysis for a new soup, Delhi Chicken. This product was especially important to Sharma because he was convinced that it would be a success and thereby a springboard for his ascent to top management. Rossi discussed the product with the food lab that had designed it, with the market research department that had tested it, and with the fi nance people who would have to fund its introduction. After putting together all the information, she developed the following optimistic and pessimistic sales projections:

The optimistic predictions assume a successful introduction of a popular product. The pessimistic predictions assume that the product is introduced but does not gain wide acceptance and is terminated after 5 years. Rossi thinks the most likely results are halfway between the optimistic and pessimistic predictions. Rossi learned from fi nance that this type of product introduction requires a predicted pretax rate of return of 16% before top management will authorize funds for its introduction. She also determined that the contribution margin should be about 50% on the product but could be as low as 42% or as high as 58%. Initial investment would include $3.5 million for production facilities and $2.5 million for advertising and other product introduction expenses. The production facilities would have a value of $1.2 million after 5 years. Based on her preliminary analysis, Rossi recommended to Sharma that the product not be launched. Sharma was not pleased with the recommendation. He claimed that Rossi was much too pessimistic and asked her to redo her numbers so that he could justify the product to top management. Rossi carried out further analysis, but her predictions came out no different. She became even more convinced that her projections were accurate. Yet, she was certain that if she returned to Sharma with numbers that did not support introduction of the product, she would incur his wrath. And he could be right-that is, there is so much uncertainty in the forecasts that she could easily come up with believable numbers that would support going forward with the product. She would not believe them, but she believed she could convince top management that they were accurate. The entire class could role-play this scenario or it could be done in teams of three to six persons. Here, it is acted out by a team. Choose one member of the team to be Abrielle Rossi and one to be Asim Sharma.

1. With the help of the entire team except the person chosen to be Sharma, Rossi should prepare the capital-budgeting analysis used for her first meeting with Sharma.

2. Next, Rossi should meet again with Sharma. They should try to agree on the analysis to take forward to top management. As they discuss the issues and try to come to an agreement, the remaining team members should record all the ethical judgments each discussant makes.

3. After Rossi and Sharma have completed their role-playing assignment, the entire team should assess the ethical judgments made by each and recommend an appropriate position for Rossi to take in this situation.