Reference no: EM131436232

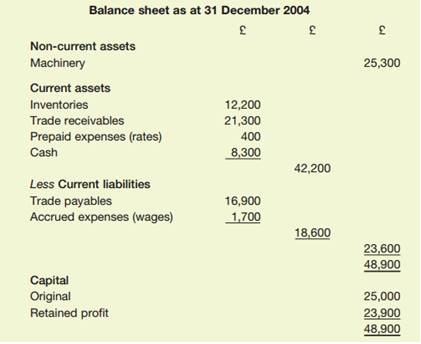

Question: The following is the balance sheet of WW Company as at 31 December 2004:

During 2005 the following transactions took place:

1. The owners withdrew capital in the form of cash of £23,000.

2. Premises were rented at an annual rental of £20,000. During the year, rent of £25,000 was paid to the owner of the premises.

3. Rates on the premises were paid during the year for the period 1 April 2005 to 31 March 2006 and amounted to £2,000.

4. Some machinery (a non-current asset), which was bought on 1 January 2004 for £13,000, has proved to be unsatisfactory. It was part-exchanged for some new machinery on 1 January 2005, and WW Limited paid a cash amount of £6,000. The new machinery wouldhave cost £15,000 had the business bought it without the trade-in.

5. Wages totalling £23,800 were paid during the year. At the end of the year, the business owed £860 of wages.

6. Electricity bills for the four quarters of the year were paid totalling £2,700.

7. Inventories totalling £143,000 were bought on credit.

8. Inventories totalling £12,000 were bought for cash.

9. Sales revenue on credit totalled £211,000 (cost £127,000).

10. Cash sales revenue totalled £42,000 (cost £25,000).

11. Receipts from trade receivables (debtors) totalled £198,000.

12. Payments to trade payables (creditors) totalled £156,000.

13. Van running expenses paid totalled £17,500.

The business uses the reducing-balance method of depreciation for non-current assets at the rate of 30 per cent each year.

Required: Prepare a balance sheet as at 31 December 2005 and an income statement (profit and loss account) for the year to that date.

|

Analyze data and explain main source of employment in city

: Analyze the data and explain the main source of employment in city (i.e. oil, health, services and other industries). When unemployment rises and declines in Calgary, please explain the reasons behind the rise and decline of unemployment.

|

|

Discuss about the balanced government budget

: Select two subjects from the following list of topics and write a analysis:Active monetary and fiscal policy,Increased government spending to fight recessions,Reducing federal government's discretionary powers,Zero-inflation target,Balanced governmen..

|

|

Manufacturing cost and shape characteristics

: Explain "Charles Ofria states that, "Different configurations have different advantages and disadvantages in terms of smoothness, manufacturing cost and shape characteristics. These advantages and disadvantages make them more suitable for certain ..

|

|

Custom programs to customer specifications

: Each of the following situations has an internal control weakness: Upside-Down Applications develops custom programs to customer's specifications. Recently, development of a new program stopped while the programmers redesigned Upside-Down's accountin..

|

|

Prepare the balance sheet and income statement

: The business uses the reducing-balance method of depreciation for non-current assets at the rate of 30 per cent each year. Required: Prepare a balance sheet as at 31 December 2005 and an income statement (profit and loss account) for the year to th..

|

|

Resistors in all the standard power ratings

: A 6.8kΩresistor has burned out in a circuit. You must replace it with another resistor with the same resistance value. If the resistor carries 10mA, what should its power rating be? Assume that you have available resistors in all the standard powe..

|

|

How can you envision yourself sharing the work with others

: How can you envision yourself sharing this work with others? While you didn't implement your project, what can you envision doing with this work to help improve your practice and impact others?

|

|

Power during the first minute greater

: If the resister is disconnected after one minute, is the power during the first minute greater than, less than, or equal to the power during a 2 minute interval?

|

|

Develop a comprehensive strategy for training new employees

: Imagine you have been selected to conduct a recruiting and staffing training program for a group of new human resource management (HRM) employees at a health care company. You need to prepare a proposal for the organization outlining your strategy..

|