Reference no: EM132213106

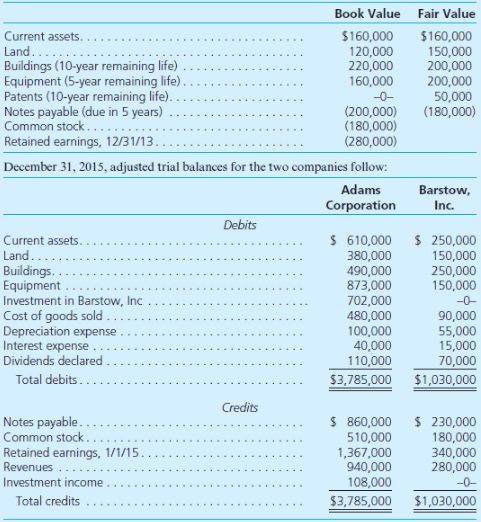

Question: Adams Corporation acquired 90 percent of the outstanding voting shares of Barstow, Inc., on December 31, 2013. Adams paid a total of $603,000 in cash for these shares. The 10 percent noncontrolling interest shares traded on a daily basis at fair value of $67,000 both before and after Adams's acquisition. On December 31, 2013, Barstow had the following account balances:

At year-end, there were no intra-entity receivables or payables.

a. Prepare schedules for acquisition-date fair-value allocations and amortizations for Adams's investment in Barstow.

b. Determine Adam's method of accounting for its investment in Barstow, Support your answer with numerical explanation.

c. Without using a worksheet or consolidation entries, determine the balances to be reported as of December 31, 2015, for this business combination.

d. To verify the figures determine in requirement (c), prepare a consolidation worksheet for Adams Corporation and Barstow, Inc. as of December 31, 2015.