Reference no: EM133016164

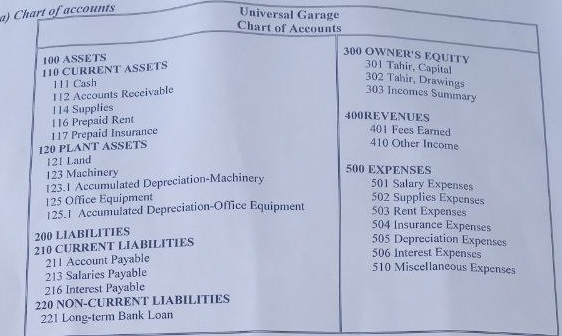

Question 1: On March 1, 2020, Tahir Muktar, a famous businessman in Addis, opened a business named "Universal Garage" which is organized as a sole proprietorship. The business is established to render car repair, maintenance and related services for fees. Below are chart of accounts for and selected transactions completed by Universal Garage in March 2020.

b) Transactions

Mar 1 Received the following assets from its owner, Tahir:

Cash .....................Br, 8,300

Supplies .................. 2,000

Office Equipment.......... .10,000

2 Borrowed Br 5,000 from Dashen Bank

3 Paid Br 1,800 for rent on a building leased for business purposes 3 Purchased welding and other repair machinery for 13r 3,600 cash

4 Paid Br 200 for a radio advertisement

8 Sold for Br 200 cash an old office equipment with a recorded cost of Br 200

13 Paid weekly salary Br 1,200

16 Received Br 4,400 from services rendered on cash

20 Paid weekly salary Br 1,200

20 Received Br500 royalties for idle repair machinery it leased to other businesses

20 Delivered service on credit, Br 6,000

21 Purchased additional repair machinery on account for Br 2,000 from Simi-Engineers

23 Received Br 5,000 additional cash investment from its owner

24 Repaid Br 1,000 bank loan and paid Br 100 interest on bank loan

26 Purchased supplies for Br 800 cash

27 Paid Br 100 for customer entertainment and other items

27 Paid weekly salary Br 1,200

31 Paid Br 500 for electricity and other utilities consumed during the month 31 Received Br 4,200 cash from credit customers

31 Paid "fakir Br 1,800 for personal uses

Required:

a) Journalize the above transactions in a two-column journal

b) Post the journal entries to "T" accounts

c) Prepare and complete a worksheet based on the following additional information

i. cost of supplies remained unconsumed on Mar 31 is Br 900

ii. The amount paid on Mar 3 is for a three-month rent

iii. The amounts of depreciation for machinery and office equipment are estimated to be Br 560 and Br 1,900 respectively

iv. Universal Garage usually pays Br 1.200 for employee's salary every saturday for a six-day work week ended on that day

v. Interest on hank loan accrued but not paid on March 31 total Br 100

d) Prepare financial statements for the month

e) Journalize and post adjusting entries

f) Journalize and post closing entries

g) Prepare post-dosing trial balance