Reference no: EM13204793

QUESTION 1: This part has 30 marks allocated to it.

Record the following transactions from June for Centinal Electronics in the appropriate journals provided in the assignment template. You are also required to complete the two general ledger accounts in the assignment template provided (you are not required to complete any other ledger account other than the two given to you in the template). Note - All sales and purchases are made on credit unless otherwise specified. Details relating to GST are provided for each transaction - please read carefully. Narrations are not required for any general journal entries. GST is calculated as 10%).

June 1 Purchased office equipment on credit from "Casual Furniture". The furniture had a cost of $63,000 (There is no GST on this transaction). A deposit of $9,000 was paid immediately and the remainder ($54,000) will be repaid over the next 12 months in equal cash payments on the last day of each month starting with the 30th of June using direct deposit. You can assume the direct deposits will occur on time and sufficient cash is available for the payments.

June 2 Received a quote from a builder (Acer Homes Ltd) to install shelves in the shop. The quote was for $3,000 plus GST and the owner of Centinal has agreed to the quote and signed off on the contract. A deposit of 10% cash (based on full amount including the GST) was paid immediately with the remainder payable when the job is completed. It is anticipated that the job will be completed on the 20th of June. The terms of the contract indicate that the balance of the quoted amount is payable 7 days after the completion of the project.

June 3 Received $1,360 cash as part payment from Langdons. The discount applicable to this payment was $40 (that is, $1,360 was received to pay for $1,400 owing - the $40 being the discount applicable to the payment).

June 4 Purchased office stationery of $500 on credit (GST is not included).

June 5 Paid, using cash, shop rent in advance for the next 12 months of $6,600 (GST is included in the $6,600).

June 6 Made a cash sale of 10 PSG televisions for $350 each (GST has not been included in the $350). The cost of each of these consoles was $180.

June 7 Received payment from customer (account receivable), Roger Ramjet as full payment of their account. There was no discount applicable for this customer.

June 8 Purchased office stationery of $286 and paid using cash. (GST is included in the $286).

June 10 Received amount owing from Delta Games - no discount was applicable to the amount received.

June 12 Sold 6 digital set top boxes for $165 each on credit, (GST is included in the $165) to Zlatan Ibrahimovic. The cost of these items was $80 each.

June 14 Paid supplier "Didier Drogba" $376.2 cash for purchases which had been made on May 31st . As the payment was made within the discount period, a discount of $41.8 was given to Centinal. The amounts shown include GST.

June 16 Purchased 20 J-Pad MP3 players from Sonny Australia for $260 each with a total freight charge of $80 (GST is not included in either of these amounts).

June 19 Collected $2,500 cash from a customer, "Bud Spencer" as payment of their account which was owing to Centinal. No discount was applicable to the amount received to settle the account.

June 20 Purchased, using cash, 12 Panasonic DVD HD Recorders for $650 each with a total freight charge of $90 (GST is not included in either of the amounts).

June 21 Acer Homes finished installing the shelves relating to the contract from the 2nd of June.

June 23 Received a $2,200 cash payment from a customer, Lionel Hutz in advance for the delivery of a Telsonic Television on the 30th

of June. (GST is included). The television will not be delivered to the customer until the 30th of June. The original cost of the television is $1,200.

June 26 Centinal paid the balance owing to Acer Homes for the shelves installed in the business.

June 28 Sold 9 Silikone Phones for $440 each (GST is included in the $440) to Rob Russo. The cost of the Phones was $160 each.

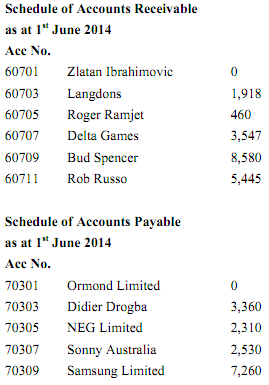

Details relating to the account receivables and account payables as at the 1st of June are shown below:

A look at the Chart of Accounts at the 31 of May also showed accrued expenses owing. Accrued Expenses at the end of May are comprised of

Salesperson's Salary* 1,750

Administrative Salary* 840

Accrued Telephone Expense** 530

*The amounts above represent accrued salaries owing at the 31st of May. Staff are paid every 14 calendar days. The last date that amounts were paid was the 21st of May (that is, salaries up to and including Friday the 23rd of May had been paid and recorded on the 23rd of May 2014). Payments for salaries during June were paid on time for June (6th and 20th of June respectively). (For simplicity, disregard PAYG or other employee entitlements such as superannuation associated with salaries.)

** The bill for the telephone was received, and recorded by the business, on the 28th of May with a due date for payment of 18th of June.

To improve the internal controls of the payment system, the business has set up an automatic payment through the online banking account to pay for the telephone bill in June. This will ensure no one forgets to pay the bill. It was arranged via Billpay to pay the bill on the due date.

REQUIRED:

- Record the transactions for the month of June in the specialised and General Journals provided in the template. Narrations are not required for entries in the General Journal.

- Complete the ledger accounts provided in the template - only the accounts provided must be completed.

Question 2:

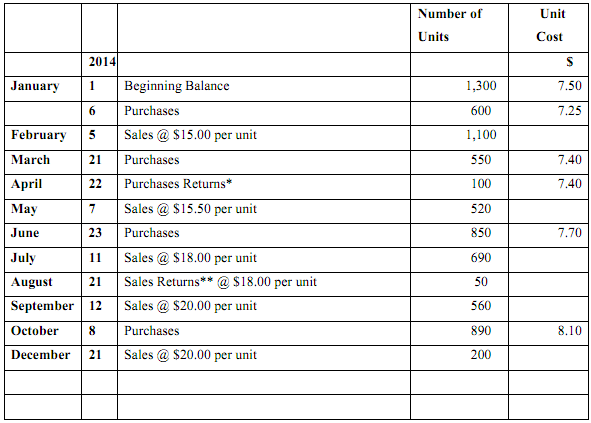

The following information has been extracted from the records of Starc's Emporium for one of their products, a picnic set. Starc's Emporium uses the perpetual inventory system. Its annual reporting date is 31 December. Ignore GST.

* There was nothing wrong with the inventory - the inventory was returned as it was the wrong item.

** The inventory was returned because it was the wrong colour - customer received a cash refund and the inventory was returned to the inventory on hand to be sold again.

A stocktake on the 31st of December revealed that there were 1,020 units on hand.

REQUIRED:

1. Using the information provided, complete the inventory card in the assignment template provided using the First In First Out (FIFO) method of inventory valuation. That is, you are using a PERPETUAL system.

2. Using the information provided, complete the inventory card in the assignment template provided using the Moving Average method of inventory valuation. That is, you are using a PERPETUAL system.

3. Prepare an extract of the Income Statement to show how Gross Profit would be calculated for the year ended 31st December, under a periodic system using the Weighted Average Valuation Method. (That is, prepare an extract of the Income Statement showing how Gross Profit would be disclosed.) Show all calculations.

4. Prepare an extract of the Income Statement to show how Gross Profit would be calculated for the year ended 31st December, under a periodic system using the First in First Out (FIFO) Valuation Method. (That is, prepare an extract of the Income Statement showing how Gross Profit would be disclosed.) Show all calculations.