Reference no: EM13329315

I. Relevant costs

Fill in each of the blanks below with the correct term.

1. Relevant costs are also known as _____________.

2. An ___________ requires a future outlay of cash and is relevant for current and future decision making.

3. An ___________ is the potential benefit lost by taking a specific action when two or more alternative choices are available.

4. A ___________ arises from a past decision and cannot be avoided or changed; it is irrelevant to future decisions.

5. ___________ refer to the incremental revenue generated from taking one particular action over another.

II. Make or buy decision

Santos Company currently manufactures one of its crucial parts at a cost of $3.40 per unit. This cost is based on a normal production rate of 50,000 units per year. Variable costs are $1.50 per unit, fixed costs related to making this part are $50,000 per year, and allocated fixed costs are $45,000 per year. Allocated fixed costs are unavoidable whether the company makes or buys the part. Santos is considering buying the part from a supplier for a quoted price of $2.70 per unit guaranteed for a three-year period. Should the company continue to manufacture the part, or should it buy the part from the outside supplier? Support your answer with analyses.

III. Sell of process decision

Cantrell Company has already manufactured 20,000 units of Product A at a cost of $20 per unit. The 20,000 units can be sold at this stage for $500,000. Alternatively, the units can be further processed at a $300,000 total additional cost and be converted into 4,000 units of Product B and 8,000 units of Product C. Per unit selling price for Product B is $75 and for Product C is $50. Prepare an analysis that shows whether or not the 20,000 units of Product A should be processed further.

IV. Sell or rework decision

Varto Company has 7,000 units of its sole product in inventory that it produced last year at a cost of $22 each. This year's model is superior to last year's and the 7,000 units

cannot be sold at last year's regular selling price of $35 each. Varto has two alternatives for these items: (1) they can be sold to a wholesaler for $8 each, or (2) they can be reworked at a cost of $125,000 and then sold for $25 each. Prepare an analysis to determine whether Varto should sell the products as is or rework them and then sell them.

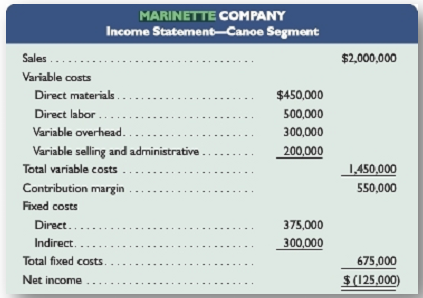

V. Income analysis of eliminating departments

Marinette Company makes several products, including canoes. The company has been experiencing losses from its canoe segment and is considering dropping that product line. The following information is available regarding its canoe segment. Should management discontinue the manufacture of canoes? Support your decision.

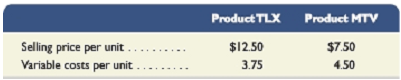

VI. Sales mix determination and analysis

Bethel Company owns a machine that can produce two specialized products. Production time for Product TLX is two units per hour and for Product MTV is five units per hour. The machine's capacity is 2,200 hours per year. Both products are sold to a single customer who has agreed to buy all of the company's output up to a maximum of 3,750 units of Product TLX and 2,000 units of Product MTV. Selling prices and variable costs per unit to produce the products follow. Determine (1) the company's most profitable sales mix and (2) the contribution margin that results from that sales mix.

VII. Analysis of income effects of additional business

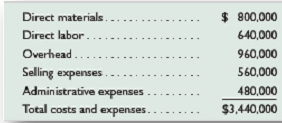

Calla Company produces skateboards that sell for $50 per unit. The company currently has the capacity to produce 90,000 skateboards per year, but is selling 80,000 skateboards per year. Annual costs for 80,000 skateboards follow.

A new retail store has offered to buy 10,000 of its skateboards for $45 per unit. The store is in a different market from Calla's regular customers and it would not affect regular sales. A study of its costs in anticipation of this additional business reveals the following:

• Direct materials and direct labor are 100% variable.

• Thirty percent of overhead is fixed at any production level from 80,000 units to 90,000 units; the remaining 70% of annual overhead costs are variable with respect to volume.

• Selling expenses are 60% variable with respect to number of units sold, and the other 40% of selling expenses are fixed.

• There will be an additional $2 per unit selling expense for this order.

• Administrative expenses would increase by a $1,000 fixed amount.

1. Prepare a three-column comparative income statement that reports the following:

a. Annual income without the special order.

b. Annual income from the special order.

c. Combined annual income from normal business and the new business.

2. Should Calla accept the order? What nonfinancial factors should Calla consider? Explain.

3. Assume that the new customer wants to buy 15,000 units instead of 10,000 units. It will only buy 15,000 units or none and will not take a partial order. Without any computations, how does this change your answer to part 2?