Reference no: EM132893653

Exercise 1

Accounting by an acquirer

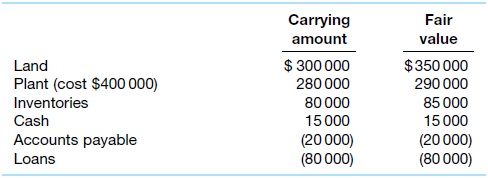

On 1 July 2020, Sonic Ltd acquired the following assets and liabilities from Screwdriver Ltd.

In exchange for these assets and liabilities, Sonic Ltd issued 100 ?000 shares that had been is- sued for $1.20 per share but at 1 July 2020 had a fair value of $6.50 per share.

Required

1. Prepare the journal entries in the records of Sonic Ltd to account for the acquisition of the assets and liabilities of Screwdriver Ltd.

2. Prepare the journal entries assuming that the fair value of Sonic Ltd shares was $6 per share.

Exercise 2

Accounting by an acquirer

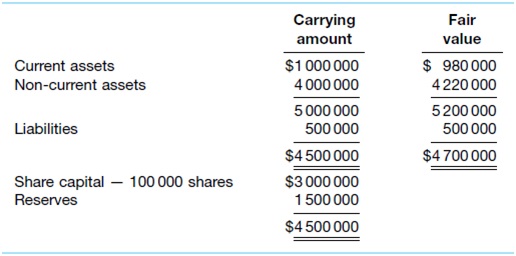

Russell Ltd acquired all the assets and liabilities of Davies Ltd on 1 July 2021. At this date, the assets and liabilities of Davies Ltd consisted of:

In exchange for these net assets, Russell Ltd agreed to:

• issue 10 Russell Ltd shares for every Davies Ltd share - Russell Ltd shares were consid- ered to have a fair value of $10 per share; costs of share issue were $500

• transfer a patent to the former shareholders of Davies Ltd - the patent was carried in the records of Russell Ltd at $350 ?000 but was considered to have a fair value of $1 mil- lion

• pay $5.20 per share in cash to each of the former shareholders of Davies Ltd.

Russell Ltd incurred $10 ?000 in costs associated with the acquisition of these net assets.

Required

1. Prepare an acquisition analysis in relation to this acquisition.

2. Prepare the journal entries in Russell Ltd to record the acquisition at 1 July 2021.