Reference no: EM131385441

Louise Baldwin commenced business as a wholesaler on 1 March 2016.

Her sales on credit during March 2016 were:

March 9 Nevilles Electrical 4 computer monitors list price £180 each, less 20% trade discount

March 17 Malt by pic 20 computer printers list price £200 each, less 25% trade discount

March 29 Nevilles Electrical Assorted software list price £460, less 20% trade discount

All transactions are subject to Value Added Tax at 10%.

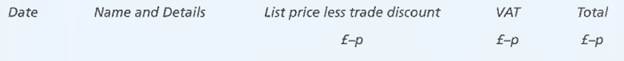

(a) Rule up a Sales Day Book and head the main columns as follows.

Enter the above information in the Sales Day Book, totalling and ruling off at the end of March 2016.

(b) Make the necessary postings from the Sales Day Book to the personal and nominal accounts in the ledger.

(c) Prepare a trial balance as at 31 March 2016.

|

Calculate his net wages

: The first £110 per week is free of income tax, on the next £60 he pays tax at the 20 per cent rate and above that he pays at the 25 per cent rate. National Insurance amounted to £32. Calculate his net wages.

|

|

Calculate his net wages

: According to the requisite tables the income tax due on his wages was £46, and National Insurance £28. Calculate his net wages.

|

|

Record above transactions in columnar book of original entry

: Record the above transactions in a columnar book of original entry and post to the general ledger in columnar form.

|

|

The purchases detailed above laira brand

: On 1 May 2017 Laira Brand owed Mudgee Ltd £2,100.47. Other than the purchases detailed above Laira Brand made credit purchases (including VAT) of £680.23 from Mudgee Ltd on 15 May. On 21 May Mudgee Ltd received a cheque for £2,500 from Laira Brand..

|

|

Prepare a trial balance as at 31 march 2016

: Make the necessary postings from the Sales Day Book to the personal and nominal accounts in the ledger.- Prepare a trial balance as at 31 March 2016.

|

|

A three column cash book for a wine wholesaler

: A three-column cash book for a wine wholesaler is to be written up from the following details, balanced-off, and the relevant discount accounts in the general ledger shown.

|

|

Enter the given in the three column cash book

: Enter the following in the three-column cash book of an office supply shop. Balance-off the cash book at the end of the month and show the discount accounts in the general ledger.

|

|

Enter up the sales day book from the given details

: You are to enter up the Sales Day Book from the following details. Post the items to the relevant accounts in the Sales Ledger and then show the transfer to the sales account in the General Ledger.

|

|

Enter up the sales day book from the given details

: Enter up the Sales Day Book from the following details. Post the items to the relevant accounts in the Sales Ledger and then show the transfer to the sales account in the General Ledger.

|