Reference no: EM131114524

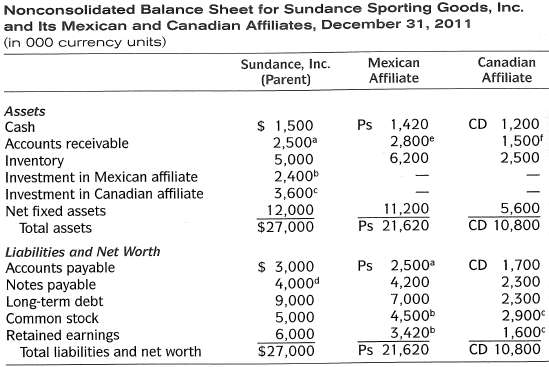

Sundance Sporting Goods, .Inc., is a U.S. manufacturer of high-quality sporting goods-principally golf, tennis, and other racquet equipment, and also lawn sports, such as croquet and badminton-with administrative offices and manufacturing facilities in Chicago, Illinois. Sundance has two wholly owned manufacturing affiliates, one In Mexico and the other in Canada. The Mexican affiliate is located in Mexico City and services all of Latin America. The Canadian affiliate is in Toronto and serves only Canada. Each affiliate keeps its books in its local currency, which is also the functional currency for the affiliate. The current exchange rates are: $1.00 = CD 1.25 = Ps3.30 = A1.00 = ¥ 105 = W800. The nonconsolidated balance sheets for Sundance and its two affiliates appear in the accompanying table.

You joined the International Treasury division of Sundance six months ago after spending the last two years receiving your MBA degree. The corporate treasurer has asked you to prepare a report analyzing all aspects of the translation exposure faced by Sundance as a MNC. She has also asked you to address in your analysis the relationship between the firm's translation exposure and its transaction exposure. After performing a forecast of future spot rates of exchange, you decide that you must do the following before any sensible report can be written.

a. Using the current exchange rates and the nonconsolidated balance sheets for Sundance and its affiliates, prepare a consolidated balance sheet for the MNC according to FASB 52.

b. (i) Prepare a translation exposure report for Sundance Sporting Goods, Inc., and its two affiliates.

(ii) Using the translation exposure report you have prepared, determine if any reporting currency imbalance will result from a change in exchange rates to which the firm has currency exposure. Your forecast is that exchange rates will change from $1.00 = CD 1.25 = Ps3.30 = A1.00 = ¥ 105 = W800 to $1.00 = CD1.30 = Ps3.30 = A1.03 = ¥105 = W800.

c. Prepare a second consolidated balance sheet for the MNC using the exchange rates you expect in the future. Determine how any reporting currency imbalance will affect the new consolidated balance sheet for the MNC.

d. (i) Prepare a transaction exposure report for Sundance and its affiliates. Determine if any transaction exposures are also translation exposures.

(ii) Investigate what Sundance and its affiliates can do to control its transaction and translation exposures. Determine if any of the translation exposure should be hedged.

a The parent firm is owed Ps1,320,000 by the Mexican affiliate. This sum is included in the parent's accounts receivable as $400,000, translated at Ps3.30/$1.00. The remainder of the parent's (Mexican affiliate's) accounts receivable (payable) is denominated in dollars (pesos).

b The Mexican affiliate is wholly owned by the parent firm. It is carried on the parent firm's books at $2,400,000. This represents the sum of the common stock (Ps4,500,000) and retained earnings (Ps3,420,000) on the Mexican affiliate's books, translated at Ps3.30/$1.00.

c The Canadian affiliate is wholly owned by the parent firm. It is carried on the parent firm's books at $3,600,000. This represents the sum of the common stock (CD2,900,000) and the retained earnings (CD1,600,000) on the Canadian affiliate's books, translated at CD1.25/$1.00.

d The parent firm has outstanding notes payable of ¥126,000,000 due a Japanese bank. This sum is carried on the parent firm's books as $1,200,000, translated at ¥105/$1.00. Other notes payable are denominated in U.S. dollars.

e The Mexican affiliate has sold on account A120,000 of merchandise to an Argentine import house. This sum is carried on the Mexican affiliate's books as Ps396,000, translated at A1.00/Ps3.30. Other accounts receivable are denominated in Mexican pesos.

f The Canadian affiliate has sold on account W192,000,000 of merchandise to a Korean importer. This sum is carried on the Canadian affiliate's books as CD300,000, translated at W800/CD1.25. Other accounts receivable are denominated in Canadiandollars.

|

The competitive pressures on companies within an industry

: The competitive pressures on companies within an industry come from those:

|

|

Job is vp-operations for plant of home appliance producer

: Your immediate superior on your new job is VP-Operations for one plant of a major home appliance producer. Her responsibilities cover over 8000 WIP and Raw Materials items used in making home appliances. The VP prides herself on employee accessibilit..

|

|

What is the probability that a part will have a dimension

: The dimension of a machined part has a nominal specification of 11.9 cm. The process that produces the part can be controlled to have a mean value equal to this specification, but has a standard deviation of 0.05 cm. What is the probability that a pa..

|

|

Construct large nine-cell diagram

: On a separate sheet of paper, construct a large nine-cell diagram that will represent your SWOT Matrix. Appropriately label the cells. Appropriately record McDonald’s opportunities/threats and strengths/weaknesses in your diagram.

|

|

Prepare a translation exposure report for sundance sporting

: Using the current exchange rates and the nonconsolidated balance sheets for Sundance and its affiliates, prepare a consolidated balance sheet for the MNC according to FASB 52. Prepare a translation exposure report for Sundance Sporting Goods, Inc., a..

|

|

Accounting for organization costs fontenot corporation

: Accounting for Organization Costs Fontenot Corporation was organized in 2009 and began operations at the beginning of 2010.

|

|

Accounting for trade name in early january 2009

: Compute the 2010 amortization and the 12/31/10 book value, assuming that at the beginning of 2010, Reymont determines that the trade name will provide no future benefits beyond December 31, 2013.

|

|

Recording and amortization of intangibles power glide

: Recording and Amortization of Intangibles Power glide Company, organized in 2009, has set up a single account for all intangible assets.

|

|

Correct intangible asset account as the recently appointed

: Correct Intangible Asset Account As the recently appointed auditor for Hillary Corporation, you have been asked to examine selected accounts before the 6-month financial statements of June 30, 2010, are prepared.

|