Reference no: EM13513615

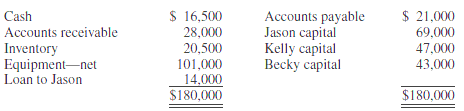

Jason, Kelly, and Becky, who share partnership profits 50 percent, 30 percent, and 20 percent, respectively, decide to liquidate their partnership. They need the cash from the partnership as soon as possible but do not want to sell the assets at fire-sale prices, so they agree to an installment liquidation. A summary balance sheet on January 1, 2011, is as follows:

�Cash is distributed to the partners at the end of each month, with $5,000 retained for possible contingencies in the liquidation process.

During January 2011, Jason agreed to offset his capital balance with his loan from the partnership, $25,000 was collected on the accounts receivable, and the balance is determined to be uncollectible. Liquidation expenses of $2,000 were paid.

During February 2011, $18,000 was collected from the sale of inventories and $90,000 collected from the sale of equipment. Additional liabilities of $3,000 were discovered, and $2,000 of liquidation expenses were paid. All cash was then distributed in a final liquidation.

REQUIRED

Prepare a statement of partnership liquidation with supporting safe payments schedules for each cash distribution.

|

Calculate the ending capital balances

: Prepare general journal entries showing the transactions admitting Bridges and Terrell to the partnership and calculate the ending capital balances of all four partners after the transactions.

|

|

What is the childs speed with respect to the ground

: Walking on a Merry-Go-Round A child of mass stands at rest near the rim of a stationary merry-go-round of radius and moment of inertia. What is the child's speed with respect to the ground

|

|

Define what is the temperature of the gas

: The root mean square velocity of argon atoms is found to be 5.67x103 m/s. What is the temperature of the gas

|

|

Classsify the following costs as variable

: Classsify the following costs as variable (V), fixed (F), or semivariable (S) in terms of their behavior with respect to volume or level of activity.

|

|

Prepare a statement of partnership liquidation

: Prepare a statement of partnership liquidation with supporting safe payments schedules for each cash distribution.

|

|

Determine the force acting on the board

: A uniform diving board, of length 5.21 m and mass 50.4 kg, is supported at two points; one support is located L1 = 3.32 m from the end of the board and the second is at 4.89 m from the end. What is the force acting on the board due to the right sup..

|

|

Classify each cost as direct materials

: Classify each cost as direct materials, direct labor, or overhead.

|

|

How to evaluate the new volume of the gas

: Somebody puts an expandable balloon on the opening of the bottle, without any gas escaping. The outside pressure is 1.10atm and the temperature has decreased to 25.8 degree celsius. Calculate the new volume of the gas.

|

|

Describes events and transactions

: Includes all changes in stockholders' equity during a period except those resulting from investments by stockholders and distributions to stockholders.

|