Reference no: EM131525844

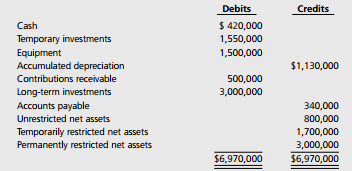

Question: The Grant Wood Arts Association had the following trial balance as of January 1, 2012, the first day of the year:

During the year ended December 31, 2012, the following transactions occurred:

1. Cash contributions during the year included

( a ) unrestricted, $2,000,000;

( b ) restricted for neighborhood productions, $500,000;

( c ) restricted by the donor for endowment purposes, $1,000,000; and

( d ) restricted by the donor for equipment purchases, $450,000.

2. Additional unrestricted cash receipts included

( a ) admission charges, $300,000;

( b ) interest income, $200,000; and

( c ) tuition, $500,000, and

( d ) $100,000 borrowed from the bank for working capital purposes.

3. Donors made pledges late in 2012 in a pledge drive that indicated the funds were to be used in 2013; the amount was $400,000.

4. A multiyear pledge (temporarily restricted) was made at the end of the year by a private foundation. The foundation pledged $100,000 per year for the next five years (at the end of the year) for unrestricted purposes. The applicable discount rate is 6 percent, and the present value of the pledge is $421,236.

5. $200,000 in funds restricted for neighborhood productions was recorded in accounts payable and paid.

6. The Arts Association had $500,000 in pledges in 2011 that were intended by the donors to be expended in 2012 for unrestricted purposes. The cash was received in 2012.

7. $350,000 in cash restricted for equipment purchases was expended. The Arts Association records all fixed assets in the Unrestricted class of net assets.

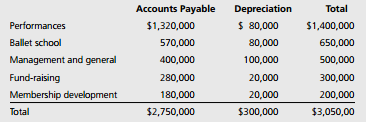

8. In addition to the $200,000 in transaction 5, expenses incurred through Accounts Payable and Depreciation amounted to:

9. Cash of $2,800,000 was paid on accounts payable during the year.

10. At year-end, temporary investments were purchased with cash as follows:

( a ) unrestricted, $750,000; and

( b ) temporarily restricted, $300,000. In addition, investments in the amount of $1,000,000 were purchased with permanently restricted cash.

11. At year-end, the recorded value of temporary investments was the same as fair value. However, the fair value of the investments recorded as permanently restricted amounted to $4,200,000. Gains and losses of permanent endowments are required by the donor to be maintained in the endowment.

12. Interest, an administrative expense, is accrued on the outstanding bank note in the amount of $4,000.

Required: a. Prepare journal entries to reflect the transactions. Prepare closing entries.

b. Prepare a Statement of Activities for the Arts Association for the year ending December 31, 2012.

c. Prepare a Statement of Financial Position for the Arts Association as of December 31, 2012. Use the format in the text; combine assets but show net assets by class.

d. Prepare a Statement of Cash Flows for the Arts Association for the year ending December 31, 2012. Use the direct method. Assume the temporary investments are not cash equivalents. (Hint: The $400,000 for plant expansion in transaction 1 is a financing transaction.)