Reference no: EM131317965

Calcor Company has been a wholesale distributor of automobile parts for domestic automakers for 20 years. Calcor has suffered through the recent slump in the domestic auto industry, and its performance has not rebounded to the levels of the industry as a whole.

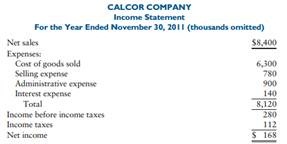

Calcor's single-step income statement for the year ended November 30, 2011, follows:

Calcor's return on sales before interest and taxes was 5% in fiscal 2011 compared with the industry average of 9%. Calcor's turnover of average assets of four times per year and return on average assets before interest and taxes of 20% are both well below the industry average.

Joe Kuhn, president of Calcor, wishes to improve these ratios and raise them nearer to the industry averages. He established the following goals for Calcor Company for fiscal 2012:

|

Return on sales before interest and taxes

|

8%

|

|

Turnover of average assets

|

5 times per year

|

|

Return on average assets before interest and taxes

|

30%

|

For fiscal 2012, Kuhn and the rest of Calcor's management team are considering the following actions, which they expect will improve profitability and result in a 5% increase in unit sales:

1. Increase selling prices 10%.

2. Increase advertising by $420,000 and hold all other selling and administrative expenses at fiscal 2011 levels.

3. Improve customer service by increasing average current assets (inventory and accounts receivable) by a total of $300,000, and hold all other assets at fiscal 2011 levels.

4. Finance the additional assets at an annual interest rate of 10% and hold all other interest expense at fiscal 2011 levels.

5. Improve the quality of products carried; this will increase the units of goods sold by 4%.

6. Calcor's 2012 effective income tax rate is expected to be 40%-the same as in fiscal 2011.

Required

a. Prepare a single-step pro forma income statement for Calcor Company for the year ended November 30, 2012, assuming that Calcor's planned actions would be carried out and that the 5% increase in unit sales would be realized.

b. Calculate the following ratios for Calcor Company for the 2011-2012 fiscal year and state whether Kuhn's goal would be achieved:

1. Return on sales before interest and taxes.

2. Turnover of average assets.

3. Return on average assets before interest and taxes.

c. Would it be possible for Calcor Company to achieve the first two of Kuhn's goals without achieving his third goal of a 30% return on average assets before interest and taxes? Explain your answer.

|

Define types of bullying to which amanda todd was subjected

: Describe at least two types of bullying to which Amanda Todd was subjected.Identify at least three consequences that Amanda Todd experienced as a result of being bullied, and discuss her attempts to deal with them.Recommend two strategies that you..

|

|

Net present value of the aftertax benefits

: Assuming a discount rate of 8%, calcualte the net present value of the aftertax benefits. Sandras life expectancy is 20 more years, and she could receive an annuity of $35,000 a year for the next 20 years. Because her annual income would be relat..

|

|

How much would you be willing to pay for a ticket to draw

: If you are offered $20 to draw a red ball from a bag that contains six green balls, two blue balls, and two red balls, how much would you be willing to pay for a ticket to draw?

|

|

Standard deviation on the market

: What is required return on a portfolio with a standard deviation of 22%, if the risk-free rate is 2%, the expected return on the market is 11%, and the standard deviation on the market is 15%?

|

|

Prepare a single step pro forma income statement

: Prepare a single-step pro forma income statement for Calcor Company for the year ended November 30, 2012, assuming that Calcor's planned actions would be carried out and that the 5% increase in unit sales would be realized.

|

|

Write a critical swot analysis on lenovos outlook

: Critically analyse the current state of international corporate PC market to get a better sense for the environment to address the problem of Lenovo. Use the concept of Porter's Six Forces.

|

|

Net income-comprehensive income and continuing income

: Distinguish between net income, comprehensive income, and continuing income. Cite and discuss examples of income statement items that create differences between these three income measures. 250 words

|

|

The beta coefficient for stock

: The beta coefficient for Stock C is bc = 0.4, while that for Stock D is bD = -0.5. (Stock D's beta is negative, indicating that its rate of return rises whenever returns on most other stocks fall. There are very few negative beta stocks, although gol..

|

|

What potential ethical issues can you see developing

: What potential ethical issues can you see developing over affordable housing? Why? Are there any lessons learned from the "code of ethics" assignment that you can apply to this case?

|