Reference no: EM13504210

1. Preparation of merchandise purchases budgets

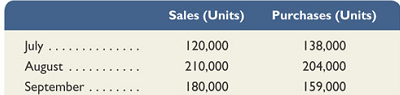

Formworks Company prepares monthly budgets. The current budget plans for a September ending inventory of 15,000 units. Company policy is to end each month with merchandise inventory equal to a specified percent of budgeted sales for the following month. Budgeted sales and merchandise purchases for the three most recent months follow.

1. Prepare the merchandise purchases budget for the months of July, August, and September.

2. Compute the ratio of ending inventory to the next month's sales for each budget prepared in part 1.

3. How many units are budgeted for sale in October?

II. Preparation of cash budgets

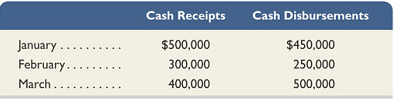

Kasik Company budgeted the following cash receipts and cash disbursements for the first three months of next year.

According to a credit agreement with the company's bank, Kasik promises to have a minimum cash balance of $30,000 at each month-end. In return, the bank has agreed that the company can borrow up to $150,000 at an annual interest rate of 12%, paid the last day of each month. The interest is computed based on the beginning balance of the loan for the month. The company has a cash balance of $30,000 and a loan balance of $60,000 at January 1. Prepare monthly cash budgets for each of the first three months of next year.

III. Computing budgeted cash payments for purchases

Powerdyne Company's cost of goods sold is consistently 60% of sales. The company plans to carry ending merchandise inventory for each month equal to 40% of the next month's budgeted cost of goods sold. All merchandise is purchased on credit, and 50% of the purchases made during a month is paid for in that month. Another 35% is paid for during the first month after purchase, and the remaining 15% is paid for during the second month after purchase.

Expected dollar sales are:

August (actual), $150,000

September (actual), $350,000

October (estimated), $200,000

November (estimated) $300,000.

Use this information to determine October's expected cash payments for purchases.

IV. Budgeted Cash Receipts

Emily Company has sales on account and sales for cash. Specifically, 60% of its sales are on account and 40% are for cash. Credit sales are collected in full in the month following the sale. The company forecasts sales of $525,000 for April, $535,000 for May, and $560,000 for June. The beginning balance of Accounts Receivable on April 1 is $300,000.

Prepare a schedule of budgeted cash receipts for April, May, and June.