Reference no: EM13507592

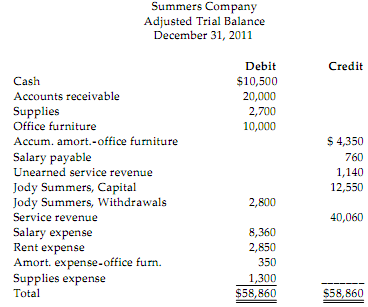

1) Based on the following adjusted trial balance, prepare an income statement, SOE, and Balance Sheet for Summers Company for the year ended December 31, 2011. Prepare the closing entries for Summers Company on December 31, 2011

2) Prepare journal entries for the following independent situations.

a) The allowance for doubtful accounts has a $500 credit balance prior to adjustment. An aging schedule prepared on December 31 reveals uncollectible accounts of $7,800.

b) The allowance for doubtful accounts has a $700 credit balance prior to adjustment. Net credit sales during the year are $260,000 and 4% are estimated to be uncollectible.

c) The allowance for doubtful accounts has a $800 credit balance prior to adjustment. Net credit sales during the year are $270,000 and 3.5% are estimated to be uncollectible receivable. 3)

Jack, John and Jenny earned salaries of $5,000 each during the period March 5-10, all of which were subject to 4.95% CPP, 1.73% EI deduction and 20% in income taxes. In addition, the company has agreed with its employees to withhold the following amounts: $900 for hospital insurance and $180 for union dues. The company also contributes $250/employer to an employment retirement program. To date Jack and John have earned 30,000, while Jenny has earned 55,000. CPP is paid on earnings between $3,500 and the exempt ceiling of $42,800. Maximum insurable earnings for EI is $42,300

a) Prepare the March 10 general journal entry to record the payroll

b) Prepare the general journal entry to record the employer's payroll expenses resulting from the March 10 payroll

4) Prepare journal entries in good form for the following transactions.

a) Owner, Mira Addington invested equipment valued at $4,500 and cash of $7,000 into the business.

b) Purchased office supplies for cash, $550.

c) Paid $700 for current month's rent of office space.

d) Billed a client $2,000 for services rendered.

e) Owner, Mira Addington withdrew $1,600 for personal living expenses.

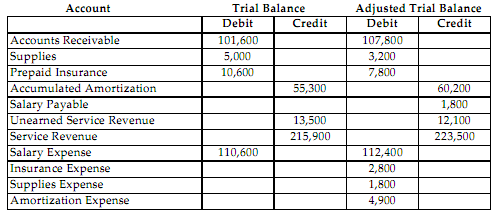

5) Based on the partial trial balance and the partial adjusted trial balance shown below, prepare the six missing adjusting entries. The adjusting entries should be dated December 31.

6) The following data are available for Wood Products Company for 2011:

Sales revenue $400,500

January 1 inventory at cost 110,600

Purchases 275,000

Sales Returns 1,500

Gross profit ratio 30%

Compute the estimated ending inventory value. 7)

The petty cash fund had the following petty cash ticket.:

Toner for a printer $42

Freight to deliver goods sold 39

Freight on inventory purchased. 112

Miscellaneous expense 10

Postage expense 25

$228

Assume that the business has established a petty cash fund in the amount of $250 and that the amount of cash in the fund at the time of replenishment is $24. The business uses a perpetual inventory system. Prepare the entry to replenish the the fund on February 28. 8)

The following are transactions for Latest Fashions for the month of June.

June 2 Purchased 2 000 of inventory under terms 1/10, n/60 and FOB shipping point from Trendy Manufacturing.

The merchandise had cost Trendy $1 800

June 7 Returned defective merchandise to Trendy Manufacturing with invoice price of $400.

June 8 Paid the freight charges on the purchase from Trendy Manufacturing in cash for $100.

June 9 Sold merchandise to New Miss Store on account for $5 000 with terms 2/15, n/60 FOB shipping point.

Cost of the merchandise sold was $4 000.

June 10 Paid Trendy Manufacturing the balance on account.

June 12 Granted sales allowance of $300 to New Miss Store for defective merchandise.

June 25 Collected balance owing from New Miss Store.

a) Prepare the journal entries for Latest Fashions for the transactions listed, assuming that Latest Fashions uses a perpetual inventory system.

b) Prepare a mutli-step income statement. Assume operating expenses were $3500.