Reference no: EM13847274

Module- Purchase-to-Pay Controls

Problem 1:

You are presented with 6 unique problems below that could have been prevented, detected and/or corrected by using an appropriate control plan. Use the various control plans listed in your text (see pages listed below) to choose the BEST plan to handle each problem that is presented. In your answer, explain WHY you believe this is the best control plan to address this issue. When in doubt, it is always better to choose a preventive control plan rather than a detective/corrective control plan.

• Chapter 12 list of control plans: pp. 482-484

• Chapter 13 list of control plans: pp. 522-524

(a) Schmoe Manufacturing works with a few vendors who provide good quality raw materials at a competitive price, but who are sometimes negligent in providing timely invoices to Schmoe. Schmoe has a policy of taking advantage of cash discounts possible, but it hasn't always gotten discounts since invoices are arriving too late to take advantage of the discounts.

(b) Receiving dock employees at Schmoe have allowed a few inventory orders to be recorded and forwarded to the warehouse that were never ordered.

(c) Schmoe's new cash disbursements clerk, Mindy, prepares payments in batches twice per week as payment due dates arrive. She has discovered a way to prepare one payment each week to herself by attaching a fake invoice that she creates on her local printer. Her friend, Karen the cashier, approves each batch, and the two enjoy a day the spa each week on Schmoe's dime.

(d) Schmoe Manufacturing buys fabric to make a variety of sportswear. On its most order to Snerd, it ordered 100 bolts of navy blue nylon. When the fabric arrived, 90 bolts were in the shipment, and receiving appropriately recorded the 90 as received. The other 10 appropriately remained on backorder at Snerd. Snerd sent an invoice for the entire order of 100 bolts, which was promptly approved and paid

by Schmoe.

(e) Schmoe Manufacturing buys fabric to make a variety of sportswear. It recently decided to try a new vendor for its cotton. When the cotton was used in production, workers noted that it was much more prone to tear on the machines than the previous cotton that had been used in the past.

(f) Joe works in the purchasing department as a buyer for Schmoe Manufacturing. His friend, Jed, works at a supplier that does not currently do business with Schmoe. Jed gets commissions on sales that he makes, so Joe has decided to get a percentage of Jed's commissions by ordering inventory from Jed's company that is not needed or used by Schmoe.

Problem 2:

The narrative and flowchart below provide information about Sparkle Inc., a janitorial supply company. Please complete the following two tasks:

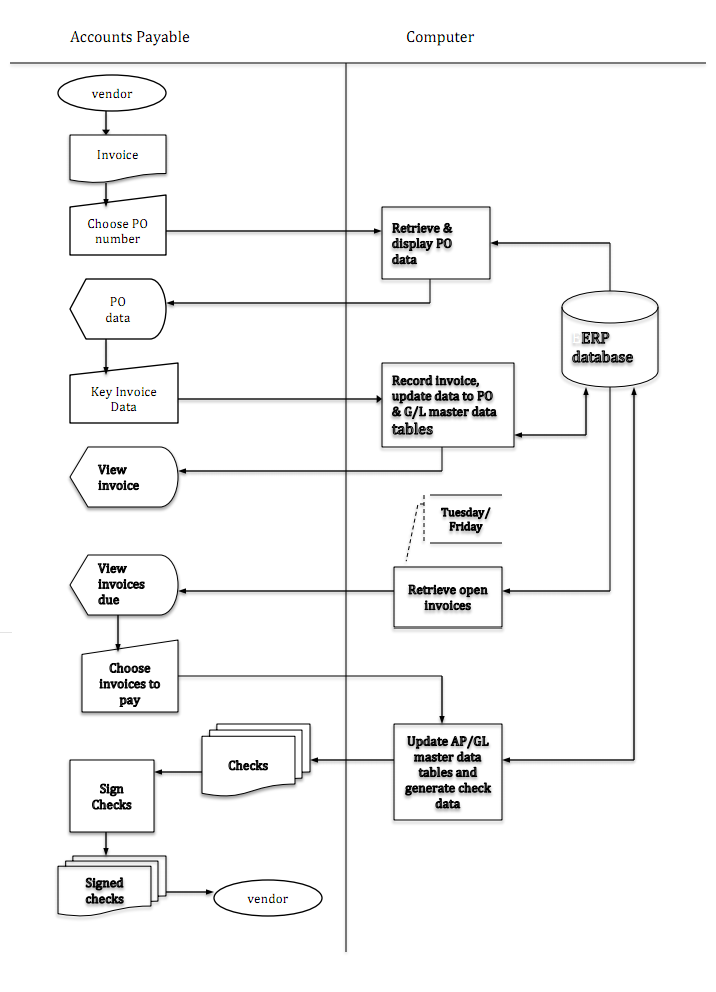

(a) Using Excel, prepare a control matrix and the associated explanations for Sparkle's business process as described in the narrative on the next page and shown in the flowchart on the page that follows that. Note that it should be either a "purchasing" process or an "AP/CD" process. You must decide which fits the narrative and flowchart.

For purposes of preparing the "effectiveness" columns of your flowchart, you should assume that you have the following 2 goals:

1. Optimize cash discounts

2. Ensure that the amount of cash maintained in demand deposit accounts is sufficient (but not excessive) to satisfy expected cash disbursements.

Tip: Find the corresponding example of a control matrix in the textbook, based on your choice of process (purchasing or AP/CD as described above). Set up a "skeleton" in Excel (e.g., column headings and room for the control plans you identify in rows) that is like the match you find in the text. The only real differences should be in the "Present" and "Missing" control plans that you list in each row-these must be custom-tailored to the narrative/flowchart for Sparkle on the next pages-and the cell entries that you make (choose the correct match of control plans to control goals-note that some control plans meet more than one control goal).

(b) Annotate the flowchart that I have attached once your control matrix and explanations are complete. You can literally write or type on the flowchart that I have created, then scan it into a pdf file or take a GOOD picture of it with your phone's camera and save it as a jpeg, png or pdf file.

The narrative appears on the next page, and the flowchart follows on the page after that. Narrative for Sparkle, Inc.:

Sparkle, Inc. is a distributor of industrial cleaning supplies, selling to a variety of businesses in southern California. Its entire "purchase-to-pay" process is run using MS Dynamics GP ERP software. The MS SQL Server database that stores the data for the enterprise system is run on a server in a central computer area, where all of the data is stored. Sparkle also uses this same software for other areas of the business, including sales financials (i.e., general ledger).

Sparkle has not implemented EDI, but instead relies on manual invoices from its various vendors to initiate its AP/CD process. When the accounts payable department receives invoices from vendors, an AP clerk, using his/her own desktop computer, uses the Dynamics GP interface to locate the corresponding PO number that is associated with the invoice that was received. When the clerk locates the PO number, the screen displays the existing PO. At this point, the clerk enters any data from the invoice that is necessary to adjust the PO. The computer then matches the newly entered invoice data to the existing PO data and the data that was recorded at the time the goods were received. If there are price or quantity differences, the ERP's workflow capability automatically routes the invoice to the purchasing department for approval. Upon approval, the computer records the invoice and updates the PO and general ledger master data.

On Tuesdays and Fridays of each week, a clerk in the accounts payable department reviews unpaid invoices using the Dynamics GP software to view these items on his/her screen. The clerk places a checkmark in the box for each invoice that will be paid. Once this step is performed, the checks are printed in the accounts payable department.

Simultaneously, the system updates the accounts payable and general ledger master data. Accounts payable runs the batch of checks through a check-signing machine and mails them to the vendor.