Reference no: EM13487731

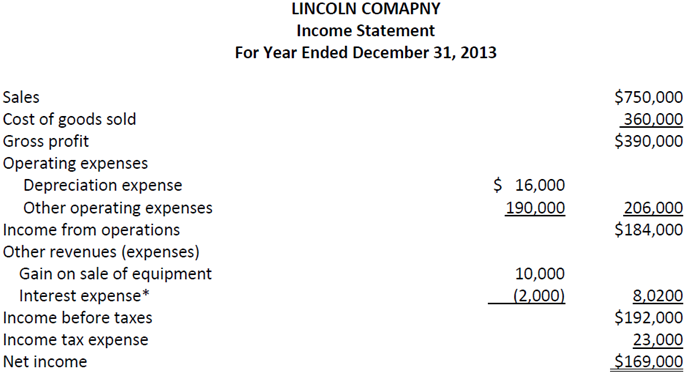

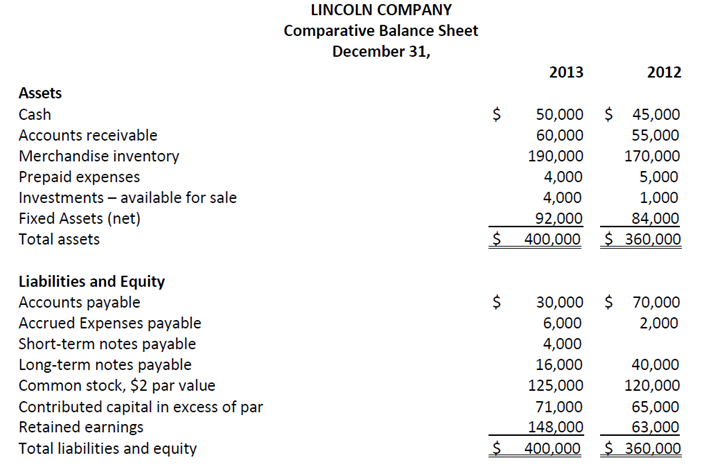

Lincoln Company, a merchandiser, recently completed its calendar-year 2013 operations.

Identified as an expense rather than a revenue by reporting the amount in parantheses.

Additional Information on Year 2013 Transactions

1. Sold equipment costing $20,000, with accumulated depreciation of $14,000, for $16,000 cash.

2. Purchased equipment costing $30,000 by making a cash down payment of $14,000 and issuing a $16,000 long-term note payable for the balance.

3. Borrowed $5,000 cash by signing a 90-day note payable.

4. Paid cash to reduce one $40,000 long-term notes payable.

5. Issued 1,000 new shares of common stock for cash at $11 per share.

6. Declared and paid cash dividends of $84,000.

7. Interest expense paid in cash, $4,000

8. Income taxes paid in cash, $22,000.

Required:

1. Prepare a complete statement of cash flows using the indirect method.

2. Disclose any noncash investing and financing activities and supplemental cash flow information in the manner discussed in the textbook and the powerpoint. If you don't know what I mean, look it up.

3. Answer the following questions based on your completed Statement of Cash Flows:

a. Looking at the investing activities only what was the single largest sources of cash during and the single largest use of cash during 2013?

b. Looking at financing activities only what was the single largest sources of cash during and the single largest use of cash during 2013?

c. What caused the biggest difference between net income on the income statement and cash flows from operating activities on the cash flow statement. The answer is found on the cash flow statement itself.

|

What is the present value of your windfall

: You have been offered a unique investment opportunity. If you invest $10,000 today, you will receive $500 one year from now, $1500 two years from now, and $10,000 ten years from now.

|

|

Company will be researched in terms of it service

: Company will be researched in terms of its service,includingservice environment, employees, customers, policies and processes.'the 10 pages case must be written in APA format.double spaced, size 12, font times new roman

|

|

The hydrochloric acid react with gold metal to produce gold

: a. On the basis of your intuitive understanding of the chemical properties of sodium and gold, where in your activity series would you place sodium and gold? b. Will hydrochloric acid react with gold metal to produce gold (III) ions and hyrdogen g..

|

|

Change and stress management at hia

: Change and stress management at HIA , by Eugence Y.J.Tee and Neal M Ashkanasy

|

|

Prepare a complete statement of cash flows

: Prepare a complete statement of cash flows using the indirect method and disclose any noncash investing and financing activities and supplemental cash flow information in the manner discussed in the textbook and the powerpoint. If you don't know wh..

|

|

Quality management

: Quality Management

|

|

How to drive the reaction to the right

: The reaction CH4+2O2==CO2+2H2O is exothermic. Which of the following will drive the reaction to the right? A. a decrease in temperature B. an increase in temperature C. addition of a catalyst D. removal of CH4

|

|

Explain what changes will occur in the concentration

: Consider the reaction: 2SO2(g)+O2(g)?2SO3(g) What changes will occur in the concentration of SO2,O2, and SO3 at equilibrium if we were to: a. increase temperature b. increase pressure c. increase SO2 d. add a catalyst e. add helium at constant pre..

|

|

How long will the part spin until it stops

: A manchine part has the shape of a uniform sphere of mass 225g and diametere 3.00cm. It is spinning about a frictionless axle through its center, how long will the part spin until it stops

|