Reference no: EM131052663

Using Ratios to Compare Alternative Investment Opportunities

The financial statements for Armstrong and Blair companies are summarized here:

|

|

|

Blair Company |

|

|

Armstrong Company

|

|

Balance Sheet

|

|

|

|

|

Cash

|

$

|

35.000

|

$22.000

|

|

Accounts Receivable. Net

|

|

40.000

|

30.000

|

|

Inventory

|

|

100.000

|

40.000

|

|

Equipment Net

|

|

180,000 |

300,000 |

|

Other Assets

|

|

45.000

|

408.000

|

|

Total Assets

|

$

|

400000 |

$800,000

|

|

Current Liabilities

|

$

|

100.000

|

$50,000

|

|

NOte Payable (long-term)

|

|

60000 |

37000 |

|

Total Liabilities

|

|

160.000

|

420.000

|

|

Common Stock (par $10)

|

|

150.000

|

200.000

|

|

Additional Paid-in Capital

|

|

30.000

|

110.000

|

|

RotalnettEtnik101

|

|

60000

|

70.000

|

|

Total Liabilities and

|

|

$400.000

|

$800.000

|

|

Stockholders' Equity

|

|

|

|

|

Income Statement

|

|

|

|

|

Sales Revenue

|

$

|

450.000

|

$810.000

|

|

Cost of Goods Sold

|

|

245.000

|

405.000

|

|

Other Expenses

|

|

160.000

|

315.000

|

|

Net Income

|

$

|

45.000 |

$90.000 |

|

Other Data

|

|

|

|

|

Estimated value of each share at end of year

|

$

|

18 |

$27 |

|

Selected Data from

|

|

|

|

|

Previous Year

|

|

|

|

|

Accounts Receivable. Net

|

$

|

20.000

|

$38.000

|

|

Inventory

|

|

92,000 |

45.000

|

|

Equipment, Net

|

|

180,000 |

300,000 |

|

Note Payable (long-term)

|

|

60.000

|

70.000

|

|

Total Stockholders' Equity

|

|

231.000

|

440.000

|

The companies are in the same line of business and are direct competitors in a large metropolitan area. Both have been in business approximately 10 years and each has had steady growth. Despite these similarities, the management of each has a different viewpoint in many respects. Blair is more conservative, and as its president said, "We avoid what we consider to be undue risk." Both companies use straight-line depreciation, but Blair estimates slightly shorter useful lives than Armstrong. No shares were issued in the current year and neither company is publicly held. Blair Company has an annual audit by a CPA, but Armstrong Company does not. Assume the end-of-year total assets and net equipment balances approximate the year's average and all sales are on account.

Required:

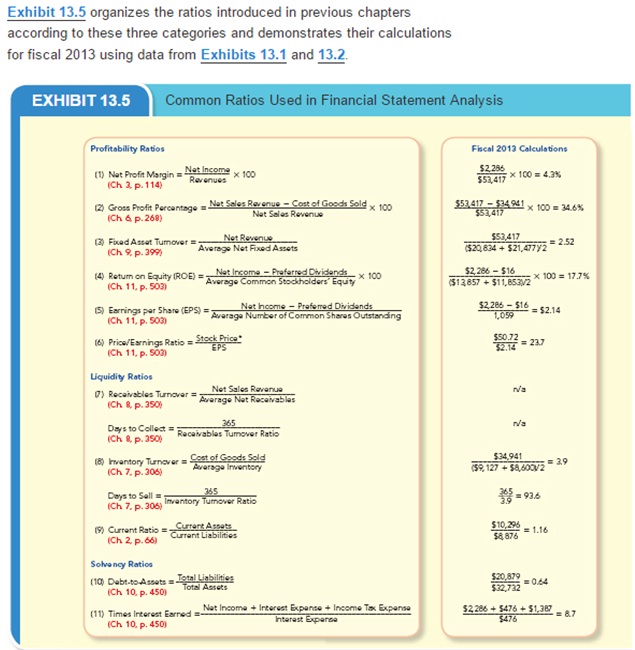

1. Calculate the ratios in Exhibit 13.5 for which sufficient information is available. Round all calculations to two decimal places.

TIP: To calculate EPS, use the balance in Common Stock to determine the number of shares outstanding. Common Stock equals the par value per share times the number of shares.

2. A venture capitalist is considering buying shares in one of the two companies. Based on the data given, prepare a comparative written evaluation of the ratio analyses (and any other available information) and conclude with your recommended choice.

TIP: Comment on how accounting differences affect your evaluations, if at all.

Project Requirements

Financial Accounting Project Is in Chapter 13, Under Coached Problem CP13-6 on Page 21. The Companies are Armstrong and Blair. This is a hand in problem where you do the ratios in Connect and the written portion is send via atlas email along with the connect portion. You can send both the ratios and written portion via atlas email. This is an analysis type project where you explain each ratio and then tell what it means to each company. After the above you then pick a company that you would financially support and defend your answer by interpreting the ratio's that you used to come to your conclusion. The interest is in why you made the decision. Use exhibit 13-5 for the ratio's you are to calculate. Look on page 597.