Reference no: EM131527792

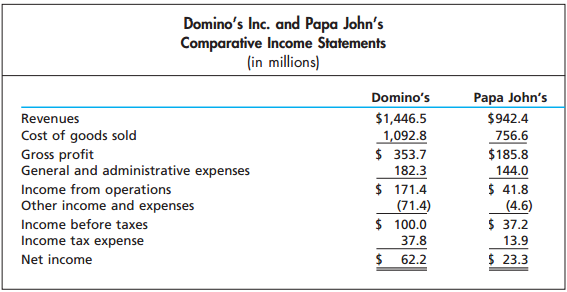

Question: Domino's Inc. and Papa John's International Inc. are the two largest pizza delivery companies in the United States. Both companies have both company-owned and franchise store locations, featuring a delivery-oriented store design. Franchised restaurants are owned by other entities that pay fees to the franchiser based upon franchise contract provisions. The accounts receivable are associated with these fees. Comparative condensed income statements for a recent fiscal year for both companies are as follows:

Average balances from comparative balance sheets for both companies were as follows for a recent year (in millions):

Domino's Papa John's

Average total assets $449.7 $360.9

Average accounts receivable 68.9 21.5

Average inventory 20.5 20.1

Average fixed assets 132.0 200.5

1. Prepare a common-size income statement for both companies. Round to one decimal place.

2. Determine the DuPont formula for each company. Round to two decimal places.

3. Calculate the accounts receivable, inventory, and fixed asset turnover for each company. Round to two decimal places.

4. Analyze and compare the two companies, based on your answers in parts (1) through (3).