Reference no: EM131488768

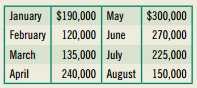

Question: (Cash budget) The Sharpe Corporation's projected sales for the first 8 months of 2016 are shown in the corresponding table Of Sharpe's sales, 10 percent is for cash, another 60 percent is collected in the month following the sales, and 30 percent is collected in the second month following sales. November and December sales for 2015 were $220,000 and $175,000, respectively

Sharpe purchases its raw materials 2 months in advance of its sales. The purchases are equal to 60 percent of the final sales price of Sharpe's products. The supplier is paid 1 month after it makes a delivery. For example, purchases for April sales are made in February, and payment is made in March. In addition, Sharpe pays $10,000 per month for rent and $20,000 each month for other expenditures. Tax prepayments of $22,500 are made each quarter, beginning in March. The company's cash balance on December 31, 2015, was $22,000. This is the minimum balance the firm wants to maintain. Any borrowing that is needed to maintain this minimum is paid off in the subsequent month if there is sufficient cash. Interest on short-term loans (12 percent) is paid monthly. Borrowing to meet estimated monthly cash needs takes place at the beginning of the month. Thus, if in the month of April the firm expects to have a need for an additional $60,500, these funds would be borrowed at the beginning of April with interest of $605 (0.12 * 1/12 * $60,500) owed for April and paid at the beginning of May.

a. Prepare a cash budget for Sharpe covering the first 7 months of 2016.

b. Sharpe has $200,000 in notes payable due in July that must be repaid or renegotiated for an extension. Will the firm have ample cash to repay the notes?

|

Explain type of relationship between inventories and sales

: (Forecasting inventories) Scion Company wants to plan inventories for the year 2017 based on average of the past 5 years data. Scion's CEO, Radha Kar, believes.

|

|

How has cisco changed its structure and control systems

: How has Cisco changed its structure and control systems? Relate Cisco's changes to its control and evaluation systems to stages of growth in Greiner's model.

|

|

Banking services for indigenous remote customers

: How to provide banking services for indigenous remote customers.

|

|

Bridging the cultural divide

: Bridging the Cultural Divide: Addressing cultural differences can really help an international team

|

|

Prepare a cash budget for sharpe covering first seven months

: (Cash budget) The Sharpe Corporation's projected sales for the first 8 months of 2016 are shown in the corresponding table Of Sharpe's sales, 10 percent.

|

|

Why do you consider this a transformational change

: a. Why do you consider this a transformational change? b. What data/information did or should the organization have collected to assess the need for change?

|

|

Organizations in view of twenty-first century challenges

: What kind of OD assignment (e.g., Learning Activity, research-writing assignment, manageable field-based project, Prezi presentation)

|

|

Write an essay which discusses three philosophical responses

: RELS 3345 :Write an essay which discusses three philosophical responses to the Shoah. Which of these responses seems most meaningful to you, and why?

|

|

Create the cash budget for january-june

: The cost of goods sold is 60 percent of sales, purchases are all made in credit in previous month of sales. For instance, the inventories for January sales.

|