Reference no: EM133091014

HI5001 Accounting for Business Decisions - Holmes Institute

Purpose:

This assessment consists of six (6) questions and is designed to assess your level of knowledge of the key topics covered in this unit.

Question 1:

Urban Consulting, a building consulting firm has just started its business. The owner of the firm engaged you to prepare yearly financial statements for their first year ended 30 June 2020 on both the cash basis and the accrual basis. You have been provided with the following selected data for the year.

1. During the year, cash payments of $186,560 were made for salaries and other expenses incurred during the period.

2. Salaries owing to employees but not yet paid amount to $7,040.

3. Insurance of $10,560 that will cover the next financial year was prepaid at 30 June.

4. During the year, a total of $220,000 consulting fees was collected for services provided.

5. There were $14,080 in receivables at 30 June 2020 for services performed on credit.

6. On 20 June 2020, a client paid $5,280 in advance for services to be rendered during the next financial year.

Required:

a. Calculate profit under both the cash basis and the accrual basis.

b. Explain in your own words why the profits calculated above are not the same. Which financial statements assumption does this relate to?

Question 2:

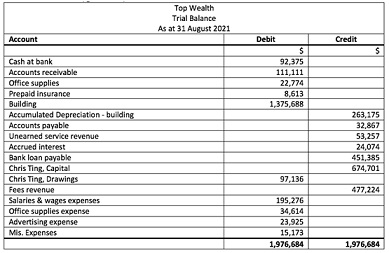

Chris Ting owns a financial planning advisory business operating under the name Top Wealth. The firm prepares financial statements every month. The unadjusted trial balance of Top Wealth as at 31 August 2021 is shown below (ignore GST).

The information below is provided for the month of August:

1. At 31 August, a physical count showed office supplies totalling $6,500 were still on hand.

2. Insurance which covers 1 year was purchased on 1 August 2021.

3. When building was purchased, its useful life was estimated to be 25 years with a residual value of $2,000 at the end of its useful life. The estimation has not changed. Straight-line method is used.

4. The amount of the unearned service revenue represents pre-collected fees from clients for services to be performed. 20% of the services have been performed in August.

5. On 20th August, Top Wealth signed an agreement to provide financial planning services to a client for a monthly fee of $1,300. It has been agreed that the fee is to be received on the 20th day of the following month. The service for the month of August was performed before 31 August. No entry was recorded when the agreement was signed.

6. Interest for a 5-year bank loan is to be paid at the end of each financial year ending 30 June. Interest on bank loan is 8% per annum.

Required:

a) Prepare necessary adjusting entries at the end of month August (round your calculations to the nearest dollar amount).

b) What is the balance of "cash at bank" and "prepaid insurance" after the adjusting entries are recorded?

Question 3:

You are working for the temporary accounting employment agency known as Accountants. Today you have been asked to work at High Jewellery, a small jewellery store that operates in inner city Sydney and is owned by Alexia Smith. Your task here is to provide advice about the firm's inventory system. The following information relates to the transactions of one type of sapphire necklace (product no. N1234) for the month of March 2021:

|

|

|

|

Unit

|

Unit Cost

|

Total Cost

|

|

March

|

1

|

Inventory on hand

|

80

|

$290.00

|

$23,200.00

|

|

|

6

|

Sales @$500

|

48

|

|

|

|

|

9

|

Purchase

|

64

|

$300.00

|

19,200.00

|

|

|

13

|

Sales returns

|

8

|

|

|

|

|

18

|

Purchase

|

80

|

$310.00

|

24,800.00

|

|

|

23

|

Sales @$510

|

96

|

|

|

Required:

a) Assuming Periodic Inventory System with FIFO cost flow method is used by High Jewellery. A physical count shows the ending inventory for the sapphire necklace is 87 units at the end of the month of March. Calculate the ending inventory and cost of sales for March 2021. (3 marks)

b) Assuming Perpetual Inventory System with FIFO cost flow method is used, prepare an inventory card and determine the ending inventory and cost of sales for the month.

c) Which inventory system would you recommend to the business and why?

Question 4:

Power Ltd. received its bank statement for the month ended 31 July 2021. It shows a credit balance of $10,321, while the firm's cash at bank ledger shows a different balance from its bank statement. It has a debit balance of $3,014 at the end of the month. At the beginning of July, its cash at bank ledger had a debit balance of $14,227.

The business's cash receipts and cash payments journals and the Bank Statement for the month are provided below:

Required:

a. Update the cash receipts and cash payments journals by entering the necessary adjustments and total the cash receipts and payments in the journals for the month.

b. Post the total cash receipts and cash payments to the Cash at Bank ledger account and balance the account (using the running balance format for the ledger account).

c. Prepare a bank reconciliation statement for the month ended 31 July 2021.

d. What is the amount of cash that should be reported on the balance sheet prepared as at 31 July 2021, and what is the beginning cash balance that will be shown on the next month's bank statement?

Question 5

During June 2021, the following transactions occurred in Michael Ltd,a business that sells stationery to companies on credit.The entity's accounting period ends on 30 June each year.The accounting records of Michael Ltdin 2021 reveals the following. Ignore GST.

|

|

$

|

|

Cash sales (for the year)

|

23,000

|

|

Credit sales (for the year)

|

1,752,300

|

|

Credit sales returns and allowances (for the year)

|

148,500

|

|

Accounts receivable (balance at 30 June 2021)

|

538,725

|

|

Allowance for doubtful debts (credit balance since 30 June 2020)

|

5,200

|

Michael Ltd has been using the percentage of net credit sales method to determine its bad debts expense each year. As per past experience, the entity's yearly bad debts expense had been estimated at 1.5% of net credit sales revenue.

The management of the business has decided to compare the current method with the ageing method.You have been provided with the following analysis related to the accounts receivable.

Required:

(a) Prepare the journal entries to adjust the Allowance for Doubtful Debts at 30 June 2021 under each of the following methods. Show your working.

i. Using the net credit sales method

ii. Using the ageing of accounts receivable method.

(b) Determine the balance in the Allowance for Doubtful Debts account at 30 June 2021 under both methods.

Question 6

Local Constructions Ltd purchased a truck costing $153,500. The truck was shipped to the company at a cost of $2,500. It is expected to have a residual value of $9,500 at the end of its useful life of 10 years or 330,000 kilometres. The firm's financial year ends on 31 December each year. Ignore GST.

Required:

a) Assume the truck was purchased on 1 January 2019 and that the accounting period ends on 31 December. Calculate the depreciation expense for the third year using each of the following depreciation methods

• straight-line

• diminishing balance (depreciation rate has been calculated as 25%)

• units of production (assume the truck was driven 50,000 km, 90,000 km, 88,000 km respectively in year 1, 2 and 3).

b) Prepare the relevant section of the financial statement that shows how the truck would appear in the financial statement prepared at the end of the 3rd financial year using the straight-line method.