Reference no: EM132297066

Foundations of Accounting - Workbook/Logbook Assignment

Assessment Details:

This assessment is designed to assess your technical skills in completing accounting cycle effectively. You required to form a group (2 to 3 students), select a hypothetical business (either from the provided links to the real-life projects or a project case from an organisation of your selection). The project should be in final stage of initial process, with either a signed off project charter or in the stage of getting the approval of the project charter. You are required to complete an accounting cycle in excel spreadsheet incorporating business transactions from commencement to one accounting period.

The Task: The part of assignment consists of four theoretical and computational Parts. Each Theory Question should meet the minimum word requirements where applicable.

Part A - Discuss the roles of the following organisations which regulate the company structures in Australia?

a) Financial Reporting Council (FRC)

b) Australian Accounting Standards Board (AASB)

c) IFRS Interpretations Committee

d) Australian Securities and Investments Commission (ASIC)

e) Australian Stock Exchange (ASX).

Part B - As a partial requirement of the SBM3105, you are required to individually prepare a workbook/logbook in excel on the following accounting events of Azam's Legal Practice Pty Ltd.:

After successfully completing the advocateship and getting experienced enough, Advocate Azam commenced his own law practice in Southeast Melbourne on October 1, 2017. His practice, known as Azam's Legal Practice Pty Ltd, experienced numerous events and transactions. Followings are the beginning balances of all the Accounts of his Legal Practice at October 1, 2018:

|

Cash

Books & Stationeries

Prepaid Insurance

Land

Buildings

Equipment

|

19,600

5,900

6,000

25,000

125,000

26,000

|

|

Accounts Payable

Salaries Payable

Unearned Service Revenues

Mortgage Payable

Azam's Equity

Drawings

|

20,500

2,500

19,500

70,000

100,000

5,000

|

Followings are the selected events and transactions extracted from Azam's Legal Practice during October 2018.

1 Azam added $400,000 cash by investing at Azam's Legal Practice Pty Ltd.

4 Purchased books & stationeries costing $30,000 by paying $10,800 cash.

5 Purchased equipments costing $40,000 by paying S20,500 cash.

6 Billed $10,500 for clients who have already paid.

8 Incurred advertising expense of $10,800 on account.

9 Paid Accounts Payable in full

10 Paid for salaries payable in full.

11 Paid salaries to employees $15,000.

12 Hired Mrs. Azam as practice manager effective on October 1, 2018.

13 Paid life insurance premium covering 12 months from October, $12,000. It is regarded as prepaid insurance.

15 Paid $10,000 cash for a license renewal. This is recorded as administrative expenses.

17 Withdrew $12,500 cash for personal use.

19 Paid rent for office $7,500 for October.

20 Received and paid bills of $2,500 for utilities.

25 Received $57,000 in cash from services. This is to be recorded as service revenues.

30 Paid the balance owed for advertising expenses incurred on October 8.

31 Salaries incurred but not paid amounting $12,500.

Instructions:

a) Enter the beginning balances in the concerned ledger.

b) Journalize the October transactions on the "Azam's Legal Practice Pty Ltd." book of journal.

Hints: explanations and references are not mandatory. The book of journal shows following lists of accounts: Cash; Azam's Equity; Books & Stationeries; Equipments; Administrative Expense; Advertising Expense; Advertising Payable; Accounts Payable; Salaries Expense; Prepaid Insurance; Drawings; Service Revenues; Rent Expense; Utilities Expense.

c) Post the October journal entries to the concerned ledger account.

d) Prepare a trial balance at October 31, 2018 by putting the balance of the concerned account in the trial balance.

e) Prepare the balance sheet for the Azam Legal Practice Pty Ltd. from the trail balance.

Part C - The Richmond Electronics Pty Ltd. sell skin care products made from organic ingredients. They have been operating for the year 2017. The bank balance at the beginning of the year is $12,000. A summary of their business transactions is below.

|

Receipts from customers

|

217,000

|

|

Dividends received

|

4,000

|

|

Interest received

|

7,000

|

|

Payments to suppliers

|

98,000

|

|

Payments for electricity, rent, telephone and insurance

|

5,000

|

|

Interest paid

|

8,000

|

|

Taxes paid

|

9,000

|

|

Proceeds from sale of property

|

52,000

|

|

Payments for motor vehicle purchased

|

21,000

|

|

Equity injection by owner

|

30,000

|

|

Proceeds from loan

|

15,000

|

|

Repayment of loan

|

25,000

|

|

Drawing by owner

|

12,000

|

Based on the above information, prepare a statement of cash flows for the Richmond Electronics Pty Ltd.

|

Cash flows from operating activities

|

|

|

Receipts from customers

|

|

|

Dividends received

|

|

|

Interest received

|

|

|

Payments to suppliers

|

|

|

Payments for electricity, rent, telephone and insurance

|

|

|

Interest paid

|

|

|

Taxes paid

|

|

|

Net cash flows from operating activities

|

|

|

|

|

Cash flows from investing activities

|

|

|

Proceeds from sale of property

|

|

|

Payments for motor vehicle purchased

|

|

|

Net cash flows from investing activities

|

|

|

|

|

Cash flows from financing activities

|

|

|

Equity injection

|

|

|

Proceeds from loan/borrowing

|

|

|

Loan repayment

|

|

|

Drawings

|

|

|

Net cash flows from investing activities

|

|

|

Net flows from all activities

|

|

|

Beginning cash balance

|

|

|

Ending cash balance

|

|

Part D - Performing financial analysis using financial ratio

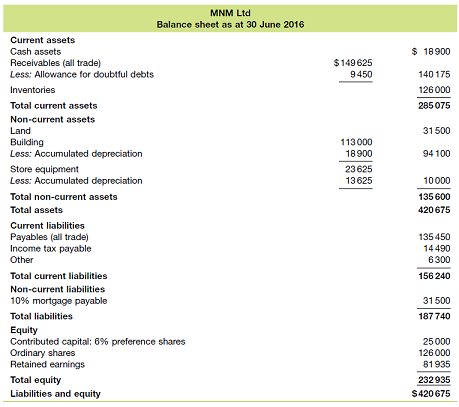

The following financial statements were prepared for the management of MNM Ltd. The statements contain some information that will be disclosed in note form in the general purpose financial statements to be issued.

|

MNM Ltd Statement of profit or loss for the year ended 30 June 2016

|

|

Sales revenue

|

$462,500

|

|

Cost of sales

|

307,500

|

|

Gross profit

|

155,000

|

|

Expenses (including tax and finance)

|

80,000

|

|

Profit

|

$75,000

|

Additional information -

1. The balances of certain accounts at the beginning of the year are:

|

Accounts receivable (gross)

|

$157,500

|

|

Allowance for doubtful debts

|

(14,175)

|

|

Inventories

|

110,250

|

2. Total assets and total equity at the beginning of the year were $387 500 and $190 500 respectively.

3. Income tax expense for the year was $31 500. Net finance expenses were $3150.

Required - Identify and calculate the ratios that a financial analyst might calculate to give some indication of the following:

a. the entity's earning ability;

b. the extent to which internal sources have been used to finance asset acquisitions;

c. the rapidity with which accounts receivable are collected;

d. the ability of the entity to meet unexpected demands for working capital;

e. the ability of the entity's earning to cover its interest commitments;

f. the length of time taken by the entity to sell its inventories.

Attachment:- Assignment Files.rar