Reference no: EM13170897

Question 1

Please answer the followings:

a. What is the maximum price that you are willing to pay for a machine if it is expected to provide annual savings of $20,000 at the end of each year for 10 years and to have a resale value of $50,000 at the end of year 10. Assume an interest rate of 9% p.a. compounded annually.

b. If $8,000 is deposited annually starting on January 1, 2010 and earns 9% p.a. compounded annually, how much will be accumulated by December 31, 2019?

c. Compute the cost of an investment if it earns $6,000 at the end of every 3 months for 5 years at 12% compounded quarterly.

d. How much must be invested now -to receive $40,000 for ten years if the first $40,000 is received today and the interest rate is 8% p.a. compounded annually?

e. A machine will be leased for 15 years with rent received at the beginning of each year. If the machine cost is $160,000 and return of 10% p.a. compounded annually is required, compute the amount of the annual rent.

f. Determine the market price of a $400,000, ten-year, 10% (pays interest semiannually. at the end of each period) bond sold to yield an interest rate of 12% p.a. compounded semi-annually.

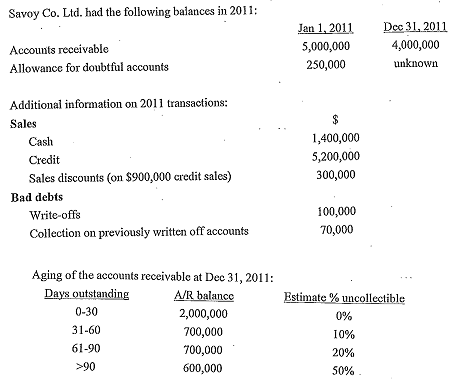

Question 2:

Required:

a. How much cash was collected from accounts receivable during 2011?

b. Prepare the journal entry to record the sale revenue of $900,000 and related discounts using both the gross and net method. Repeat the same using net method if Such discounts were not taken by customers under the net method.

c. Assume sales discounts were taken by customers and that gross method is used, compute total gross sales, net sales and bad debt expenses in 2011.

d. What would the bad debt expenses be if Savoy wanted to use the percentage of sales method and estimated that 4.5% of sales were not collectible?

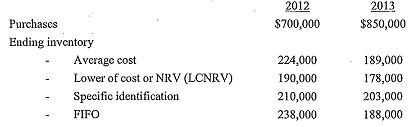

Question 3:

Stevenson Ltd. began operations on January 1, 2012. Merchandise purchases and four alternative methods of valuing inventory for the first two years of operations were summarized below:

Required:

a. Calculate COGS using the four alternative methods and determine the cost flow assumption or inventory valuation method that would report the highest net income for 2012.

b. Assuming that FIFO had been used for both years, how much would the cost of goods sold be in 2013?

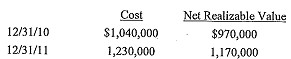

Question 4:

Adrian Company began operations in 2010 and had the following ending inventory information at cost and at LCNRV on December 31, 2010 and December 31, 2011:

Required:

a. Using a perpetual inventory system and the cost-of-goods-sold method, prepare the journal enhies required at December 31, 2010 and December 31, 2011.

b. Using a perpetual system and the loss method with an allowance account, prepare the journal entries required at December 31, 2010 and December 31, 2011.

|

What is the partial pressure of methane

: Three gases, hydrogen, argon, and methane are confined in a 8.00 L vessel at a pressure of 6.00 atm. The vessel contains 4.00 moles of hydrogen, 5.00 moles of argon, and 2.00 moles of methane. What is the partial pressure of methane?

|

|

Statethe isotopic percentage abundance atomic weight

: The atomic weight of Sm is 150.36 and that of Nd is 144.24. The isotopic percentage abundance of 147Sm is 15.0 and that of 144Nd is 23.954.

|

|

Food producers love big boxes

: Food producers love big boxes because they serve as billboards on store shelves. Walmart wants to change this practice and promises suppliers that their shelf spaces won't shrink even if their boxes do.

|

|

What is the ph of a solution

: what is the ph of a solution that is 0.100 M in HCl and also 0.125 M in HC2H3O2? What is the concentration of the acetate ion in this solution?

|

|

Perpetual inventory system and the cost-of-goods-sold method

: Perpetual system and the loss method with an allowance account, prepare the journal entries required at December 31, 2010 and December 31, 2011.

|

|

State a sample of a refrigeration gas in a volume

: A sample of a refrigeration gas in a volume of 410 mL, at a pressure of 1.26 atm, and at a temperature of 11.0 °C, was compressed into a volume of 172 mL with a pressure

|

|

Relationship between individual in the wider society

: Schaefer defines the sociological imagination as “an awareness of the relationship between an individual in the wider society, both today and in the past” (p. 5). Let’s begin our discussion this week by considering a particular scenario.

|

|

What is the molecular formula of the compound

: A gaseous compound containing hydrogen and carbon is decomposed and found to contain 85.63% C and 14.37% H by mass. The mass of 258 mL of the gas, measured at STP, is found to be 0.646 g. What is the molecular formula of the compound?

|

|

Explain when a sample of neon with a volume and a pressure

: When a sample of neon with a volume of 628 mL and a pressure

|