Reference no: EM132486777

Topic - Budgets

Learning objectives - After studying this presentation, you should be able to:

- Communicate the role of planning and budgeting as a process of improving profit performance and value creation;

- Appreciate the view of budgeting as a process of bargaining and choice to arrive at an acceptable allocation of resources, or as a process to monitor and motivate performance;

- Prepare the necessary budget schedules and integrate them into a comprehensive budget to produce budgeted financial statements.

- Construct and manipulate with sensitivity analysis computerized budget spreadsheets,

Questions -

Q1. Outline the meaning of the profit planning or strategic budgeting process.

Q2. Explain why it is important that an organisation's budget be linked to strategy.

Q3. What are the objectives of participative budgeting?

Q4. What methods do organisations use to minimise budgetary slack?

Q5. What are some of the challenges that organisations face when allocating budget authority and responsibility?

Exercises -

1. Preparation of receipts from debtors schedule and cash budget

Elvstrom Company prepares monthly cash budgets. Provided below is a set of relevant data extracted from existing reports, and the sub-budgets for the two months of September and October.

|

|

September

|

October

|

|

Credit sales

|

$314,000

|

$412,000

|

|

Direct material purchases

|

160,000

|

216,000

|

|

Direct labour

|

51,400

|

55,200

|

|

Manufacturing overhead

|

21,600

|

23,400

|

|

Marketing and administration expenses

|

39,000

|

39,000

|

|

Proceeds from sale of old equipment

|

|

8,200

|

|

Cash payments for new IT equipment

|

16,500

|

|

All sales are on credit. Collections from debtors normally have the following pattern: 60 per cent in the month of sale, 30 per cent in the month following the sale, and 10 per cent in the second month following the sale. Fortunately, Elvstrom does not have much trouble with bad debts.

Sales in June, July and August were $295 000, $266 000 and $302 000 respectively. Direct material purchases are paid for in the month following the purchase. Purchases in August were $182 000. Manufacturing overhead includes $12 500 for depreciation expense, while the marketing and administration expenses include an amount off $5600 for depreciation expenses. Elvstrom expects to be able to repay the principal on a $50 000 loan in October.

Required -

(a) Prepare a schedule of receipts from debtors for the two months ending 31 October.

(b) Prepare a cash budget for September and October. The cash balance at 31 August was $12 600.

(c) As part of its longer term plans, Elvstrom was hoping to commence a product reinvention program for one of its core products. The project would require an initial cash commitment of $30 000. Management was hoping to fund this from the cash fl ows of the business. Does this seem feasible?

2. Purchase, cost of goods sold, and cash collection budgets

The Zel Company operates at local flea markets. It has budgeted the following sales for the indicated months.

|

|

June

|

July

|

August

|

|

Sales on account

|

$1,500,000

|

$1,600,000

|

$1,700,000

|

|

Cash sales

|

200,000

|

210,000

|

220,000

|

|

Total sales

|

$1,700,000

|

$1,810,000

|

$1,920,000

|

Zel's success in this specialty market is due in large part to the extension of credit terms and the budgeting techniques implemented by the entity's owner, Barbara Zel. Ms Zel is a recycler; that is, she collects her merchandise daily at neighbourhood garage sales and sells the merchandise weekly at regional flea markets. All merchandise is marked up to sell at its invoice cost (as purchased at garage sales) plus 25 per cent. Stated differently, cost is 80 per cent of selling price. Merchandise inventories at the beginning of each month are 30 per cent of that month's forecasted cost of goods sold. With respect to sales on account, 40 per cent of receivables are collected in the month of sale, 50 per cent are collected in the month following, and 10 per cent are never collected.

Required -

(a) What is the anticipated cost of goods sold for June?

(b) What is the beginning inventory for July expected to be?

(c) What are the July purchases expected to be?

(d) What are the forecasted July cash collections?

3. Direct materials budgeted payments

New Ventures intends to start business on the first of January. Production plans for the first four months of operations are as follows:

|

January

|

20,000 units

|

|

February

|

50,000 units

|

|

March

|

70,000 units

|

|

April

|

70,000 units

|

Each unit requires 2 kilograms of material. The entity would like to end each month with enough raw material inventory on hand to cover 25 per cent of the following month's production needs. The material costs $7 per kilogram. The managers anticipate being able to pay for 40 per cent of its purchases in the month of purchase. They will receive a 10 per cent discount for these early payments. They anticipate having to defer payment to the next month on 60 per cent of their purchases. No discount will be taken on these late payments. The business starts with no inventories on January 1.

Required - Determine the budgeted payments for purchases of materials for each of the first three months of operations.

4. Flexible budget and variances; performance measurement; reasons for variances

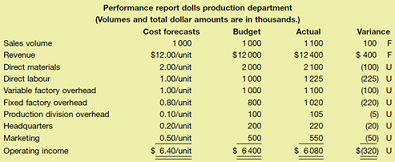

Play Time Toys is organised into two major divisions: marketing and production. The production division is further divided into three departments: puzzles, dolls and video games. Each production department has its own manager.

The entity's management believes that all costs must be covered by sales of the three product lines. Therefore, a portion of headquarters, marketing, and the production division costs are allocated to each product line.

The entity's accountant prepared the following performance report for the manager of the dolls production department.

Required -

(a) Is Play Time using a static budget or a flexible budget to calculate variances? Explain. Do you agree with this approach? Why?

(b) Develop an appropriate benchmark for evaluating the performance of the dolls production department. Decide whether to include or exclude each cost category, and explain your decisions.

(c) Use the benchmark you created in part (b) to calculate variances.

(d) Review the variances from part (c). Briefly describe the types of operating or budgeting problems that might have caused these variances.

5. Prepare cash budget

A college student, Brad Worth, plans to sell atomic alarm clocks with CD players over the internet and by mail order to help pay his expenses during the summer semester. He buys the clocks for $32 and sells them for $50. If payment by check accompanies the mail orders (estimated to be 40 per cent of sales), he gives a 10 per cent discount. If customers include a credit card number for either internet or mail order sales (30 per cent of sales), customers receive a 5 per cent discount. The remaining collections are estimated to be:

|

One month following

|

15%

|

|

Two months following

|

6%

|

|

Three months following

|

4%

|

|

uncollectable

|

5%

|

Sales forecasts are as follows:

|

September

|

120 units

|

|

October

|

220 units

|

|

November

|

320 units

|

|

December

|

400 units

|

|

January

|

Out of the business

|

Brad plans to pay his supplier 50 per cent in the month of purchase and 50 per cent in the month following. A 6 per cent discount is granted on payments made in the month of purchase; however, he will not be able to take any discounts on September purchases because of cash flow constraints. All September purchases will be paid for in October.

He has 50 clocks on hand (purchased in August and to be paid for in September) and plans to maintain enough end-of-month inventory to meet 70 per cent of the next month's sales.

Required -

(a) Prepare schedules for monthly budgeted cash receipts and cash disbursements for this venture. During which months will Brad need to finance purchases?

(b) Brad planned simply to write off the uncollectibles. However, his accounting professor suggested he turn them over to a collection agency. How much could Brad let the collection agency keep so that he would be no worse off?