Reference no: EM131035807

NEW PROJECT ANALYSIS Holmes Manufacturing is considering a new machine that costs $250,000 and would reduce pretax manufacturing costs by $90,000 annually. Holmes would use the 3-year MACRS method to depreciate the machine, and management thinks the machine would have a value of $23,000 at the end of its 5-year operating life. The applicable depreciation rates are 33%, 45%, 15%, and 7% as discussed in Appendix 12A. Net operating working capital would increase by $25,000 initially, but it would be recovered at the end of the project's 5-year life. Holmes's marginal tax rate is 40%, and a 10% WACC is appropriate for the project.

a. Calculate the project's NPV, IRR, MIRR, and payback.

b. Assume management is unsure about the $90,000 cost savings-this figure could deviate by as much as plus or minus 20%. What would the NPV be under each of these situations?

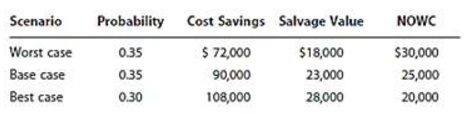

c. Suppose the CFO wants you to do a scenario analysis with different values for the cost savings, the machine's salvage value, and the net operating working capital (NOWC) requirement. She asks you to use the following probabilities and values in the scenario analysis:

Calculate the project's expected NPV, its standard deviation, and its coefficient of variation. Would you recommend that the project be accepted? Why or why not?

|

What is the reading in the pore pressure transducer

: What is the reading in the pore pressure transducer immediately before to and immediately after to - How long before 60% of the final settlement will have occurred?

|

|

Describe five scenarios

: Why would a network manager benefit from having network management tools? Describe five scenarios.

|

|

Analysis of the heart health data

: Faculty of Business, Government and Law Business Intelligence Systems 7156 and 6680. The requirement of the assessment is to build on earlier stages of the project, the proposal and presentation, to develop a computer-based DSS/BIS prototype for an..

|

|

Determine the mass of each of the two cylinders

: determine the mass of each of the two cylinders if they cause sag of s=0.5 when suspended from the rings a A and B.Note that s=0 when the cylinders are removed

|

|

New project analysis holmes manufacturing

: NEW PROJECT ANALYSIS Holmes Manufacturing is considering a new machine that costs $250,000 and would reduce pretax manufacturing costs by $90,000 annually. Holmes would use the 3-year MACRS method to depreciate the machine, and management thinks t..

|

|

What is the apparent gas constant for a gas mixture

: Can it be larger than the largest gas constant in the mixture?

|

|

Does the internet have a presentation layer

: If not, how are concerns about differences in machine architectures-for example, the different representation of integers on different machines-addressed?

|

|

Cash flows before taking account of depreciation

: SCENARIO ANALYSIS Your firm, Agrico Products, is considering a tractor that would have a cost of $36,000, would increase pretax operating cash flows before taking account of depreciation by $12,000 per year, and would be depreciated on a straight-..

|

|

Solve the system of equations

: Solve the system of equations by using the substitution method

|