Reference no: EM131592732

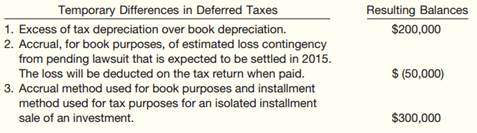

Question: At December 31, 2014, Cascade Company had a net deferred tax liability of $450,000. An explanation of the items that compose this balance is as follows.

In analyzing the temporary differences, you find that $30,000 of the depreciation temporary difference will reverse in 2015, and $120,000 of the temporary difference due to the installment sale will reverse in 2015. The tax rate for all years is 40%. Instructions Indicate the manner in which deferred taxes should be presented on Cascade Company's December 31, 2014, statement of financial position. IFRS19-11 Callaway Corp. has a deferred tax asset account with a balance of $150,000 at the end of 2014 due to a single cumulative temporary difference of $375,000. At the end of 2015, this same temporary difference has increased to a cumulative amount of $500,000. Taxable income for 2015 is $850,000. The tax rate is 40% for all years.

Instructions: (a) Record income tax expense, deferred income taxes, and income taxes payable for 2015, assuming that it is probable that the deferred tax asset will be realized.

(b) Assuming that it is probable that $30,000 of the deferred tax asset will not be realized, prepare the journal entry at the end of 2015 to recognize this probability.

|

Determine the return on total assets

: A company reports the following income statement and balance sheet information for the current year: Determine the return on total assets

|

|

Inexperienced attorney representing a rock group

: You are a first year, inexperienced attorney representing a rock group. Recently the group has told you that it wants to get out of its present.

|

|

What are tax-planning strategies

: Kleckner Company started operations in 2010. Although it has grown steadily, the company reported accumulated operating losses of $450,000.

|

|

Prepare the journal entry to recognize the probability

: Callaway Corp. has a deferred tax asset account with a balance of $150,000 at the end of 2014 due to a single cumulative temporary difference of $375,000.

|

|

Net deferred tax liability of cascade company

: At December 31, 2014, Cascade Company had a net deferred tax liability of $450,000. An explanation of the items that compose this balance is as follows.

|

|

Write a five page paper double space on any topic covered

: Write a five page paper, double space, on any topic covered in this course or related to the study of religion.

|

|

Distributed-cloud computing

: Describe the following techniques or terminologies used in cloud computing and cloud services. Use a concrete example cloud or case study.

|

|

What theories have been used in peer-reviewed research

: Essays Assignment- What theories have been used in peer-reviewed research when investigating emotion-based persuasive messages?

|

|

Discuss the statement of youngman corporation

: Youngman Corporation has temporary differences at December 31, 2014, that result in the following deferred taxes.

|