Reference no: EM13381414

- The last five months has seen inflation rising at a faster rate. Five months ago inflation was rising at an annual rate of 2%. Now 5 months later, the annual rate is over 20%. The highest in 35 years. Retail sales are strong with monthly increases of at least 4%. Car sales have been up every month for the last year. The average increase in car sales has been 5% per month the highest in 20 years. The housing market is booming with monthly increases in sales of new homes of over 4%. Unemployment is 2.8% and falling. Most economists believe the unemployment rate is well below the natural rate of unemployment of 4.5%. Most businesses have almost no inventories due to the booming economy. The money supply has been increasing at an annual rate of 12%.

1. The problem in the economy, if any (Describe from the information given in the paragraph, why you chose that particular problem)

2. The monetary and fiscal policy to be used;

3. The tools of the policy and how they work to correct the problem;

4. Any undesirable consequences that may arise when the Fed and/or the federal govt. implement the policy.

5. In your discussion please discuss the branch of the govt. that will implement each of these policies (Federal government or the Federal Reserve.).

- Unemployment for the last 6 months has been around the 4.5% mark. Although energy and food prices have been fluctuating up and down, the overall inflation rate has remained constant at a 20 year low of 2.0%. Car sales and durable good sales are rising at a moderate but steady rate. Retail sales are increasing briskly at a 4% annual rate. GDP is rising at about 4% per quarter, according to the latest data. Housing sales are rising at a moderate rate. Housing prices are about the same as they were a year ago. Inventories are at desired the level. The natural rate of unemployment is considered to be 4.5%.

1.The problem in the economy, if any

2. The monetary and fiscal policy to be used;

3. The tools of the policy and how they work to correct the problem;

4. Any undesirable consequences that may arise when the Fed and/or the federal govt. implement the policy.

5. In your discussion please discuss the branch of the govt. that will implement each of these policies

- Unemployment has increased to 11.2% this month, higher than it has been for the last 28 years. Retail sales, sales of motor vehicles, and durable good sales have all decreased dramatically over the last seven months. Housing sales are down an average of 6% over the last seven months. Foreclosures on residential properties are the highest since the Great Depression due to sub prime loans. The number of discouraged workers has increased dramatically over the last year (If we add the unemployment rate to the Discouraged worker rate, then the total unemployment rate is around 17.5%.). GDP has decreased 6.8% over the last year and the forecast is that GDP will continue to decrease. Consumer confidence is at its lowest point in 30 years. Business inventories are at an all time high. The inflation rate over the last year has been less than 1%.

1. The problem in the economy,

2. The monetary and fiscal policy to be used;

3. The tools of the policy and how they work to correct the problem;

4. Any undesirable consequences that may arise when the Fed and/or the federal govt. implement the policy.

5. In your discussion please discuss the branch of the govt. that will implement each of these policies (Federal government or the Federal Reserve.).

Part III

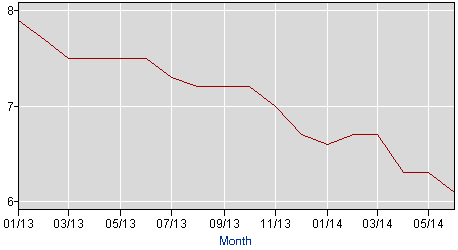

In November of 2013 the Labor Department announced that the unemployment rate fell to 7.0%. Now the unemployment rate for July 2014 is 6.1%.

- Is this a significant decrease in unemployment? Please read the reports on the bls website.

|

|

ear

|

Jan

|

Feb

|

Mar

|

Apr

|

May

|

Jun

|

Jul

|

Aug

|

Sep

|

Oct

|

Nov

|

Dec

|

|

|

2012

|

8.2

|

8.3

|

8.2

|

8.2

|

8.2

|

8.2

|

8.2

|

8.1

|

7.8

|

7.8

|

7.8

|

7.9

|

|

|

2013

|

7.9

|

7.7

|

7.5

|

7.5

|

7.5

|

7.5

|

7.3

|

7.2

|

7.2

|

7.2

|

7.0

|

6.7

|

|

|

2014

|

6.6

|

6.7

|

6.7

|

6.3

|

6.3

|

6.1

|

|

|

|

|

|

|

|

- Does it mean that the economy is starting to gather momentum for a faster growth rate? Explain. Hint: What obstacles remain for the economy to start growing at a faster rate?

- Corporations have about $1 trillion in savings that could be spent to hire workers and/or upgrade equipment and businesses. Under what circumstances will they start spending the pent up money?