Reference no: EM13873513

Question 1

Define each of the following terms:

a. Operating plan; Financial plan

b. Spontaneous Liabilities; profit margin; payout ratio

c. Additional funds needed (AFN); AFN equation; capital intensity ratio; self supporting growth rate

d. Forecasted financial statement approach using percent of sales

e. Excess capacity; lumpy assets; economies of scale

f. Full capacity sales; target fixed assets/sales ratio; required level of fixed assets

Question 2

Name five key factors that affect a firm's external financing requirements.

Problem 3

Maggie's Muffins, Inc., generated $5,000,000 in sales during 2013, and its year-end total assets were $2,500.000. Also at year-end 2013, current liabilities were 1,000,000, consisting of $300,000of notes payable, $500,000 of accounts payable, and $200,000 of accruals. Looking ahead to 2014, the company estimates that its assets must increase at the same rate as sales, its spontaneous liabilities will increase at the same rate as sales, its profit margin will be 7%, and its payout ratio will be %80. How large a sales increase can the company achieve without having to raise funds externally- that is, what is its self-supporting growth rate?

Problem 4

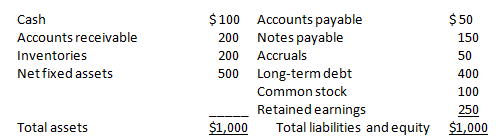

The Booth Company's sales are forecasted to double from $1,000 in 2013 to $2,000 in 2014. Here is the December 31, 2013 balance sheet:

Booth's fixed assets were used to only 50% of capacity during 2013, but its current assets were at their proper levels in relation to sales. All assets except fixed assets must increase at the same rate as sales, and fixed assets would also have to increase the same rate if the current excess capacity did not exist. Booth's after-tax profit margin is forecasted to be 5% and its payout ratio to be 60%. What is Booth's additional funds needed (AFN) for the coming year?

|

Determining the final temperature of the gas

: Determine (a) the final temperature of the gas and (b) the final pressure if no mass was withdrawn from the tank and the same final temperature was reached at the end of the process.

|

|

What is the value to the company and the supplier

: what is the value to the company and the supplier in developing and implementing a Third Party Supplier Relationship Management System (3 P.L.S.M.S.)? How can such a system provide greater efficiency

|

|

Present value for a cash flow stream

: Current share price is $25, most recent dividend is $1.25, so dividend yield is 5%. Net income is $2 million. A $1.20 dividend is paid to the 1 million shareholders. Retained earnings is $200,000. Present value for a cash flow stream of $300 per year..

|

|

How did what you learned about the cycle of violence

: How did what you learned about the Cycle of Violence relate to what we have been learning about prevention and intervention for peer victimization?

|

|

Name key factors that affect a firm''s external financing

: Name five key factors that affect a firm's external financing requirements

|

|

Describe when water turns from gas to liquid

: A bug can walk on water because of what property of water , Which phase of water has the largest distance between water molecules: Gas, Liquid, or Solid and Which phase of water has the smallest distance between water molecules: Gas, Liquid, or Solid..

|

|

What is the total expected return of this investment

: An investor with a 3-year investment horizon wants to buy a 20-year 8% coupon bond for $82.84, with YTM as 10%. He expects to be able to reinvest the coupon interests at 6%, and 3 years later he can sell the bond to offer a YTM of 7%. What is the tot..

|

|

Income statement lists the income and expenses

: Bullseye, Inc.'s 2008 income statement lists the following income and expenses: EBIT = $703,000, Interest expense = $54,500, and Taxes = $220,000. Bullseye's has no preferred stock outstanding and 330,000 shares of common stock outstanding. What are ..

|

|

Estimate the volume of the tank

: A rigid tank contains 8 kmol of O2 and 10 kmol of CO2 gases at 290 K and 150 kPa. Estimate the volume of the tank.

|