Reference no: EM13826881

When the Fed buys government securities on the open market,

a. It Is engagIrtg In expansionary monetary policy

b. interest rates will increase

c. the money supply will contract.

d. bond prices will fan

The direct effect of an increase In the money supply Is that

a. people will spend the extra money, causing the aggregate demand curve to shirt to the right and resulting in a boost to economic activity.

b. people will spend the extra (minty. raining the aggregate demand curve to shift to the kill and resulting In a recession

c. people will save the money, causing an Increase in bank deposits with the result that interest rates will Increase.

d. people will save more money, coming a decrease In economic activity and a fall in prices.

In the short run, art Increase In the discount rate usually

a. causes the equilibrium level or seal GOP and the price level to fall.

b. leads banks to hold fetter excess reserves.

c. leads to an Increase In the price or existing bonds.

d. results In alert eases In other interest tales,

The Open Market Committee of the Federal Reserve guides money supply growth.

a. true

b. false

The Federal Reserve Increased the money supply significantly during the Great Depression, but prices continued to fall anyway.

a. True

b. false

The effect of contractionary monetary policy Is to

a. decease real output and Increase the pike level.

b. increase real output and decrease the price level.

c. Increase real output and Increase the Wee level.

d. decrease real output inn decrease the price level.

An expansionary monetary policy results In lower Interest rates, which In turn

a lead to higher rates of taxation

b. cause firms to invest mote

c lead to lower bond prices.

d. cause consumers to Sava store.

Keynesian theory argues that

a. decreases In the money supply lead to Increases in the Interest rate which Increases Investment which Increases the level of real GOP

b. Increases In the money supply lead to decreases In the Interest rate which Increases Investment which Increases the level of rent GDP

c. increases In the mercy supply lead to decreases In the Interest rate winch decreases investment which decreases the level or real COP.

d. Increases In the Money supply cause consumers to spend more which reduces the unemployment rate and therefore Increases real GOP.

If the Fed contracts the money supply,

a. the price level will else.

b. Interest rates will rise.

c. firms will increase their levels of investment.

d. aggregate demand will Increase.

Contractionary monetary policy Is used to combat recessions.

a. true

b. false

A sale of bonds by the Fed generates

a. a decrease In the demand for money balances.

b. an Increase in the demand for money balances.

c an Increase In the demand for bonds and a rise In bond prices.

d. an Increase in the supply of bonds and a fell In bond prices.

The price of bonds and the Interest rate are

a. unrelated.

b. Inversely related.

C. related, but we are not slier how

d. positively belated.

Small differences in the annual growth rate of a country add up to large differences over time because of compounding.

a. true

b. false

Poorly defined property rights Inhibit economic growth.

a. tine

b rake

Which one of the following Is TRUE?

a. Small changes In the annual growth rate amount to o measurable difference in the long-term growth trend of a country

b. for every country that experiences an increase in Its growth rate, there must be another experiencing a decline

c. A well-defined system of property rights benefits only the wealthy, and consequently It produces Income inequality that will stifle economic growth.

d Restricting Imports will enhance a country's economic growth.

Which of the following Is the most Important factor affecting economic growth?

a. the rate of Interest

b. the exchange rate

c the price level

d. the rate of saving

Research has shown that the growth of developing countries is most strongly enhanced by

a. providing a good secondary education.

b. increasing the money supply.

c. providing incentives to have large families.

d. providing colleges and universities.

Economic growth is reflected in

a. growth In total output.

b. an increase in tax revenue.

c. Increases In the level of employment.

d. Increase In per capita real GDP.

A small increase in the annual rate of economic growth can lead to a larger increase In growth over time due to the effects of

a. regression towards the mean.

b. compounding.

c. averaging.

d. the money supply,

Secondary schooling makes measurable contributions to economic growth in developing countries.

a. true

b. false

Labor productivity is defined as

a. the amount of Input per worker.

b. the Increase in output per unit of machinery.

c. the amount of output per worker.

d. the amount of workers per unit of input.

The more certain property rights are, the more capital accumulation there will be, and therefore the greater economic growth.

a. true

b. false

Which one of the following helps preserve incentives to develop new technologies?

a. tariffs

b. Income taxes

c. patents

d. quantity restrictions on imports

Which one of the following Is FALSE?

a. Increases in the capital stock can improve the productivity of labor.

b. Increases in the site of the tabor force Improve labor productivity.

C. Increases in labor productivity can enhance economic growth.

d. tabor productivity contributes to economic growth.

Countries engaged in international trade specialize in production based on

a. the differences In transportation costs.

b. comparative advantage.

c. relative price levels.

d. relative foreign exchange rates.

A country can enhance its wealth by restricting imports.

a. true

b. false

Protection should be withdrawn from an Infant-industry when the companies in the industry

a. reach a sufficient size to compete with foreign firms.

b. become profitable.

c. are listed on the domestic stock exchange.

d, double their sales revenues,

If there are two goods and two countries, then one country can have

a. an absolute advantage in both goods but a comparative advantage in only one good.

b. an absolute advantage In both goods and a comparative advantage in both goods.

c. an absolute advantage in neither good and a comparative advantage In both goods.

d. an absolute advantage In one good, an absolute disadvantage in the other good, and a comparative advantage In neither.

Table 16.2

Production In Alpha

|

|

A

|

B

|

C

|

D

|

E

|

|

Forks

|

12

|

9

|

6

|

3

|

0

|

|

Knives

|

0

|

3

|

6

|

9

|

12

|

Production In Beta

|

|

A

|

B

|

C

|

D

|

E

|

|

Forks

|

4

|

3

|

2

|

a.

|

0

|

|

Knives

|

0

|

3

|

6

|

9

|

12

|

Table 16.2 shows the quantities of forks and knives that can be produced with the full amount of resources in each of two countries, Alpha and Beta.

Refer to Table 16.2. If these two countries specialize based on comparative advantage, then

a. Alpha should specialize In forks and Beta should specialize In knives.

b. Beta should produce both Items.

c. Alpha should specialize in knives and Beta should specialize in forks.

d. Alpha should specialize in producing both items.

The effect of a tariff Is to

a. shift the supply curve of the imported good to the left.

b. shift the demand curve for the imported good to the left.

c. shift the demand curve for the imported good to the right.

d. shift the supply curve of the imparted good to the right.

Table 16.1

Alpha's Production Possibilities

|

|

A

|

B

|

C

|

D

|

E

|

|

Cookies

|

4

|

3

|

2

|

1

|

0

|

|

Coffee

|

0

|

5

|

10

|

15

|

20

|

Beta's Production Possibilities

|

|

A

|

8

|

C

|

D

|

e

|

|

Cookies

|

8

|

6

|

4

|

2

|

0

|

|

Coffee

|

0

|

6

|

12

|

18

|

24

|

Table 16.1 shows the quantities of cookies and coffee that can be produced with the full amount of resources available in each of two countries, Alpha and Beta.

Using the Information In Table 16.1, which statement Is TRUE?

a. Beta has the lower opportunity cost of producing cookies.

b. Alpha has the lower opportunity cost of producing both coffee and cookies.

c. Alpha has the lower opportunity cost of producing cookies.

d. Both countries have the same opportunity cost of producing cookies.

The growth In world trade since the 1550s has been much less than the growth In world GDP.

a. true

b. false

Which of the following is a true statement?

a. Exporters benefit from trade and Importers do not.

b. free trade harms domestic producers of goods that face import competition.

c. Consumers benefit from trade and producers do not.

d. Everyone benefits from free trade in the short run.

The law that created the high level of tariffs in United Slates In the 19305 is

a. the World Trade Act.

b. the north American free Trade Agreement.

c. the Smoot-Hawley Act. d. the Compromise Tariff.

Table 16.1

|

Alpha's Production Possibilities

|

|

|

A

|

B

|

C

|

D |

E |

|

Cookies

|

4

|

3

|

2

|

1 |

0 |

|

Coffee

|

0

|

5

|

10

|

15 |

20 |

|

Beta's Production Possibilities

|

|

|

A

|

B

|

C

|

D |

E |

|

Cookies

|

8

|

6

|

4

|

2 |

0 |

|

Coffee

|

0

|

6

|

12

|

18 |

24 |

Table 16.1 shows the quantities of cookies and coffee that can be produced with the full amount of resources available in each of two countries, Alpha and Beta.

Refer to Table 16.1. The table shows the production possibilities of cookies and coffee in Alpha and Beta measured in tons. In Alpha the domestic cost of 1 ton of cookies

a. Is S tons of coffee.

b. changes with the level of coffee production.

c. changes with the level of cookie production.

d. averages 4 tons of coffee.

The European Union is

a. an organization established to resolve trade disputes among member nations.

b. a group of countries that Impose tariffs on one another's agricultural goods.

c. a restricted trade zone.

O. a common market.

Table 16.6

|

Product

|

Country X

|

Country Y

|

|

Gallons of Ice Cream

|

2,000

|

1,000

|

|

Yards of Textiles

|

6,000

|

2,000

|

Table 16.6 shows the combinations of quantities of two goods, gallons of Ice cream and yards of textiles, that can be produced with all of the resources available in two countries, X and Y.

Refer to Table 16.6. Which of the following statements is TRUE?

a. Country X has a lower opportunity cost of producing co cream than does Country Y.

b. Country Y has a comparative advantage In producing textiles.

c. Country X has a comparative advantage In producing ice cream.

d. In Country X, the opportunity cost of producing a gallon of Ice cream is three yards of textiles.

An Infant industry Is one in which

a. the firms are too new and too small to compete Internationally.

b. no country has a comparative advantage.

c. no country has an absolute advantage.

d. the products are only consumed domestically.

A financial strategy that reduces the chance of suffering losses arising from foreign exchange risk is referred to as

a. hedging.

b. conversion depletion.

c. foreign exchange leverage.

d. transaction mitigation.

Other factors held constant, a rise In the price level in Japan that exceeds the rise in the price level In other countries will most likely result In

a. a decrease In the supply of the Japanese yen.

b. an Increase In the supply of Japanese goods.

c. a depreciation of the dollar.

d. a decline in the level of Japanese exports.

The fact that the United States has a trade deficit means that

a. U.S. workers cannot compete with workers overseas.

b. the United States has a surplus in its capital account.

c. Interest rates In the United States are low compared to the world average.

d. the United States has a deficit In Its capital account.

The demand for Japanese yen will increase when

a. Japan becomes more productive relative to the United States.

b. Americans change preferences in favor of domestically produced goods.

C. America is perceived as more stable politically and economically than Japan.

d. real Interest rates In Japan fall.

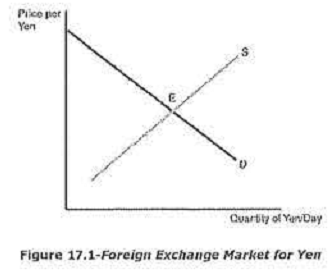

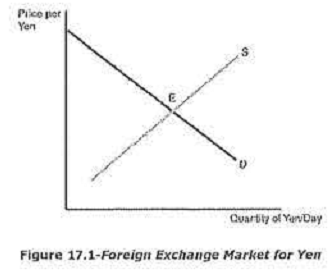

Refer to figure 17.1. Suppose E Is the original equilibrium. An increase in the inflation rate in Japan relative to the rate in the United States generates

a. an Increase In the price of yen and an increase In the quantity of yen sold per week.

b. a decrease in the price of yen and a decrease In the quantity of yen sold per week.

c. a decrease In the price of yen and an Increase In the quantity of yen sold per week.

d. an increase In the pure of yen and a decrease In the quantity of yen sold per week.

An increase in the U.S. demand for Japanese yen causes

a. an Increase In the dollar-price of yen.

b. an increase In the demand for U.S. goods.

c. an Increase In the yen-price of dollars.

d. a decrease In the supply of yen.

The balance of payments consists of the

a. capital account, official reserve transactions account, and recent account.

b. current account, official reserve transactions account, and monetary account.

c. current account, capital account, and official reserve transactions account.

d. current account, capital account, and gold flows.

An example of a unilateral transfer Is

a. a gift to your university In the United States.

b. gold payments to foreign companies.

C. a gift to a relative who lives abroad.

d. receipts from the export of financial services.

Refer to Figure 17.1. Suppose E Is the original equilibrium. The Japanese have increased their demand for U.S. goods. This will lead to

a. a decrease In the price of yen and a decrease in the quantity of yen sold per week.

b. an increase In the price of yen and a decrease In the quantity of yen sold per week.

c. an increase In the price of yen and an increase In the quantity of yen said per week,

d. a decrease in the price of yen and an Increase In the quantity of yen sold per week.

Capital account transactions occur

a. when a U.S. citizen purchases stock in a U.S. corporation.

b. because of foreign Investments.

c. when you move money from one U.S. bank to another U.S. bank.

d. when a U.S. company purchases goods from a foreign company.

If the capital account is In surplus, the current account will be in deficit.

a. true

b. false

Every transaction concerning the exportation of American goods constitutes a

a. demand for foreign currency and a supply of dollars.

b. demand for dollars, with no effect on markets for foreign currencies.

c. supply of foreign currency, with no effect on the market for dollars.

d. supply of foreign currency and demand for dollars.

Unanticipated inflation benefits

a. people a businesses who owe money.

b. people who live on fixed nominal Incomes.

c. people or businesses who lend money.

d. people with savings.

During the Great Depression,

a, the U.S. unemployment rate reached Its historical maximum.

b. most people who couldn't find work left the labor force, so the official unemployment rate remained ion. C. unemployment statistics were not collected.

d. the unemployment rate was net unusually high, but wage levels were low.

Is It possible for the unemployment rate to rise at the same time that the number of people working increases?

a.no

b. yes, If labor force growth outpaces growth In the number of people working

c. yes, If the new workers are employed less than full time

d. yes, if established workers keep their jobs but no longer have the option of necking overtime

If there Is positive, unanticipated Inflation, who benefits?

a. savers

b. people on fixed nominal incomes

C. creators

d. borrowers

The source of business fluctuations Is found In decisions made by workers who chose to vary the number of hours worked from time to time.

a. true

b. false

A lifeguard who N out of work in the winter Is

a. Frictionally unemployed.

b. Seasonally unemployed.

c. cyclically unemployed.

d. structurally unemployed.

COLA's are designed to protect workers from Inflation.

a. true

b. false

Unemployment implies that society Is

a, on the wrong point on Its production possibilities curve. b. outside Its production possibilities curve.

c. on an endpoint of the production possibilities curve.

d. Inside As production possibilities curve.

If the nominal Interest rate is 9 percent and the anticipated Inflation rate Is 4 percent, then

a. the real interest rate Is 2.5 percent.

b. the real Interest rate Is 13 percent.

c. the real Interest rate is 5 percent.

d. the real Interest rate Is 4 percent.

The 'real rate of interest' can be defined as the

a. anticipated rote of Inflation less the nominal Interest rate.

b. nominal rate of Interest less the unanticipated roe of Inflation.

c. nominal interest rate less the anticipated rate of inflation

d. the market rate of Interest expressed in today's dollars.

What Is the definition of a discouraged worker?

a. a member of the law force who is working but is discouraged about the performance of his company within the industry

b. a member of the labor force who is working but Is discouraged about Ns prospects for advancement 'titan the company c a person

c. who has dropped out of the labor force because he is discouraged about Ns prospects for employment

d. an unemployed member of the labor force who Is discouraged about his prospects for finding employment

Which of the following statements is correct?

a. An economy can go through contractions and expansions whitest!!! growing over time.

b. The depth and tiw length of all business downturns are Identical.

c. Business cycles are caused by seasonal unemployment changes.

d. Business fluctuations are caused by unanticipated Inflation.

If the amount of goods supplied by firms exceed planned spending then

a. Inventories accumulate and Arms reduce prices.

b. Inventories accumulate and firms raise Prices.

c. Inventories are depleted and firms raise prices.

d. Inventories ore depleted and firms reduce prices.

The intersection of aggregate supply and aggregate demand determines the equilibrium price level and equilibrium real output.

a. true

b. false

An Increase in the exchange value of the dollar will

a. decrease aggregate demand, thereby Increasing the price level.

b. Increase aggregate demand, thereby decreasing the price level.

c. decrease aggregate demand, thereby decreasing the price level.

d. Increase aggregate demand, thereby increasing the price level.

A decline in consumer confidence will increase aggregate supply.

a. true

b. false

The upward slope of the supply curve Is explained by

a. the open economy effect.

b. the profit MOUVO of firms.

c. the real balance effect.

d. the bargaining strength of labor unions.

What determines the total value of annual U.S. GOP?

a. the Federal Reserve Board

b. the Congressional Budget Office

c the spending decisions of consumers, firms, and governments

d. Wall Street

Because Individual demand curves slope down, the aggregate demand curve slopes up.

a. true

b. false

Aggregate supply Is

a. the summation of all product supply curves.

b. the horizontal summation of all supply craves for services.

c. the sum of all planned production In the economy.

d. the stock of al goods In the economy.

The downward slope of the aggregate demand curve shows that

a. there can never be an equilibrium between aggregate supply and aggregate demand.

b. a higher price level All cause real output demanded to be higher.

c a lower price level will cause real output demanded to be higher.

d. an Increase In aggregate demand reduces aggregate supply.

The Intersection of aggregate supply and aggregate demand Indicates

a. the equilibrium level of real output.

b. the equilibrium level of nominal output.

c the level of full employment.

d. the optimal rate of investment.

Real GOP can Increase as a result of

a. a decrease In aggregate supply.

b. Inflation.

c. a decrease in aggregate demand.

d. an Increase in aggregate demand.

A decrease In the exchange value of the dollar will

a. lower the nominal price of Imported goods.

b. not affect the business sector.

c. not affect the household sector.

d. raise the nominal price of imported goods.

A shift in aggregate demand will change the equilibrium price level.

a. true

b. false

To the extent that the crowding out effect exists, the effect of expansionary fiscal policy is dampened.

a. true

b. false

An Increase In the marginal propensity to save

a. Increases the value of the multiplier.

b. decreases the value of the multiplier.

c. increases the crowding out effect.

d. Increases the marginal propensity to consume.

If your income goes up by $1,000 per week, and your consumption goes up by $800 per week, you have a marginal propensity to save of

a. 0.8.

b. 1.0.

c. 1.2.

d. 0.2.

Contractionary fiscal policy Is used when

a. the goal Is to Increase aggregate demand.

b. the goal Is to reduce unemployment.

c. the economy Is overheated.

d. the goal is to Increase aggregate supply.

When business inventories accumulate beyond what firms had planned, the economy returns to equilibrium as the price level falls.

a. true

b. false

Equilibrium in the macro-economy occurs when

a. total planned expenditures equal real national income.

b. total planned consumption expenditures equal real national Income.

c. net exports equal Inventory changes.

d. planned investment spending equals net exports of zero.

Which one of the following Is TRUe?

a. Our federal income tax system is not an automatic stabilizer because It Is not progressive.

b. The net public debt Is equal to gross public debt minus all government Interagency borrowing.

c. The net public debt Is equal to gross public debt plus all government interagency borrowing.

d. The use of automatic stabilizers does not affect the size of the budget deficit.

Expansionary fiscal policy alms to Increase national Income without increasing the number of people employed.

a. true

b. false

The marginal propensity to save Is

a. the change In saving divided by the change in real disposable income.

b. the change in consumption divided by the change in real disposable Income.

c. consumption divided by real disposable Income.

d. saving divided by real disposable Income.

The Intent of discretionary fiscal policy is to smooth out fluctuations In business activity by shifting the aggregate supply curve.

a. true

b. false

Changes In investment spending

a. do not affect the equilibrium level of real output.

b. have a multiplier effect.

c. do not affect aggregate demand.

d. affect aggregate Supply, but not aggregate demand.

If your Income goes up by $1,000 per week, and your consumption goes up by $800 per week, you have a marginal propensity to consume of

a. 0.2.

b. 1.0.

c. 1.2.

d. 0.8.

Over the past two decades, the portion of our federal government debt held by foreigners lies decreased.

a. true

b. false

Which one the following Is TRUE?

a. The Federal Reserve regulates the money supply by changing the level of reserves In the banking system.

b. The money supply Is independent of Federal Reserve actions.

c. The money multiplier is determined by the current interest rate.

d. The Federal Reserve regulates the money supply by determining the number of banks that will be allowed to issue loans in any one year.

Which governing body determines the future growth of the U.S. money supply?

a. the Federal Open Market Committee

b. the U.S. Congress

c. the U.S. Treasury

d. the Economic Policy Committee, a body composed of the President, Treasury Secretary, and Commerce Secretary

A monetary system is preferable over the barter system because of the problems associated with

a. the law of diminishing marginal utility.

b. finding a coincidence of wants.

c. the law of Increasing relative costs.

d. cash leakages.

The existence of money In an economy promotes efficiency by

a. facilitating trade, thereby allowing for greater specialization.

b. creating an equal distribution of income.

c. allowing for the formation of corporations as legal entitles.

d. creating incentives to be self-sufficient.

Which of the following Is FALSE?

a. A medium of exchange Is something widely accepted as payment for items of value.

b. Without money, exchange In conducted by barter.

c. Barter requires a coincidence of wants.

d. The most liquid assets are those that earn interest.

Which of the following is TRUE?

a. M2 is always larger than MI.

b. Ml is always larger than M2.

c. Credit card accounts are included in Ml but not In M2.

d.112 Is the narrowest definition of the money supply.

To the extent that banks hold excess reserves, the actual expansion of the money supply will be greater than that predicted by the size of the money multiplier.

a. true

b. false

For something to serve as money, it must be

a. backed by the authority of the government.

b. light, durable, and common.

c convertible to gold.

d. generally accepted by buyers and sellers.

Which of the following assets are counted In M2?

a. real estate

b. credit cad accounts

c. mutual market mutual funds

d. gold

The Federal Reserve System

a. regulates the U.S. fiscal policy.

b. serves as the U.S. central bank.

c. consists of 8 Federal Reserve districts.

d. does not have any control over the money supply.

The need for a coincidence of wants occurs when

a. there is deflation.

b. a system of barter Is used.

c the medium of exchange is liquid.

d. there Is inflation.

Credit cord balances are included in Ml.

a. true

b. false